If you plan to live long term in a high cost metro area (such as New York, NY) buying a multi family home might be a good solution to consider. If you can afford the larger down payment, this could be advantageous because generally you pay less per sq ft than a single family house, when you factor in the potential rent from renting out the other side of the multi family.

Just to be clear on definitions we use the term “multi family” house to mean 2 or more distinct houses or apartments sold together. They must be legitimately and legally zoned as a multi family, typically with their own separate front door entrances, and at minimum separate kitchen, bathroom and bedrooms. Basically totally separate dwellings, sold together as a multi family house.

This could reduce your living expenses over the long term, because in general your future tenants rent would go up with inflation and your mortgage can be fixed rate. You can also importantly claim a primary residence tax on the proportion (eg 50%) of the multi family house you live in.

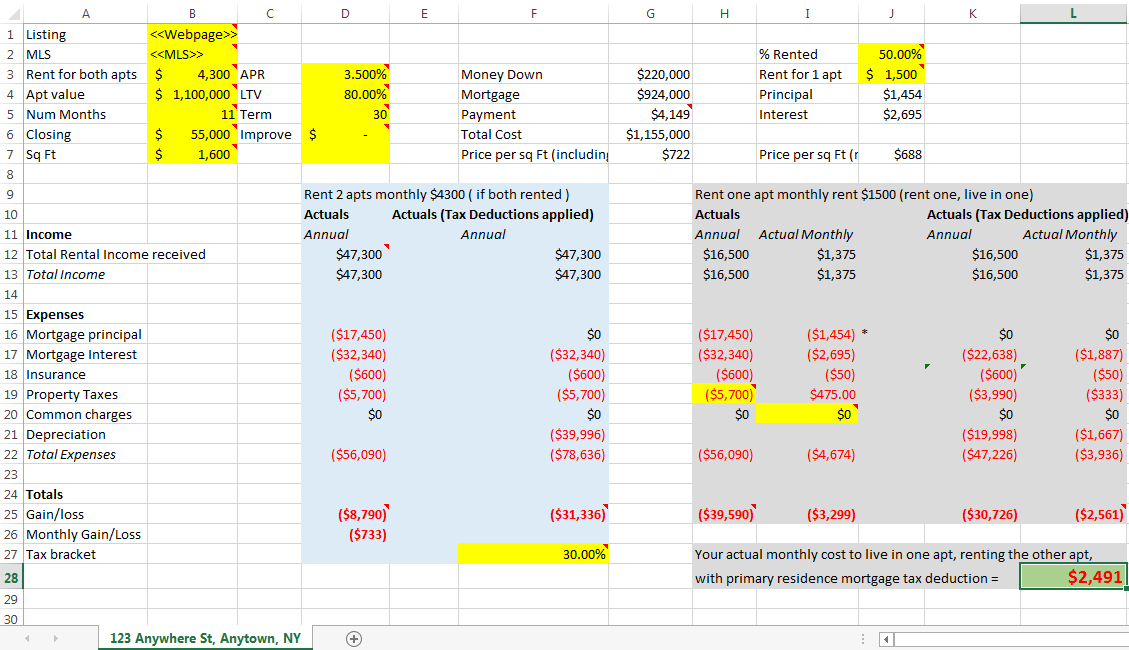

Below is an excel real estate investment calculator we use to narrow down potential real estate investment properties. We initially starting using this in the NY metro area to try and find single family investment rental property that can be purchased with immediate positive cash flow. Hint: there aren’t many. We surveyed about 100 properties and only found about 5 single family properties that could be viable according to our somewhat strict criteria. For example our criteria assumes that a tenant will only occupy the property for 11 months in any given year. Given that we were finding so few single family homes that would work as rentals, we expanded the spreadsheet to analyse multi family houses and had more success. Rents in NY metro area can be very variable between neighborhoods based on travel time to city, schools, general trendiness (etc). However as they say, the Math don’t lie, so we now this multi family spreadsheet to weed out opportunities. This was also with a view to having one half of a multi family as a primary residence, with the other tenants paying part of your mortgage.

Click this link to download the template that you could use for valuing your own properties.

There is a generic example in the spreadsheet, but you can just modify the yellow fields that for your own target property.

Many fields have comments attached to them (with a red triangle in the corner) – so just mouse over to see instructions for how to complete that field.

The spreadsheet template is the result of approximately 80 hours work visiting or analyzing 100 properties in the NY metro area.

Obviously the methodology can be applied to any market.