This trade exit on GBTC describes how exiting Bitcoin Investment Trust due to premium was decided. The original GBTC position was purchased in March 2017. To recap the GBTC is an investment trust whose price is tied to bitcoin. The historically high premium to the actual underlying bitcoin price is the main reasoning for selling our GBTC position and replacing it with bitcoin and etheruem products that can replicate similar exposure (without that premium). This trade was IRA eligible so there was no issue of paying extra capital gains by selling after 11 months (instead of waiting for 12 months for long term capital gains to kick in).

Exiting Bitcoin Investment Trust due to Premium

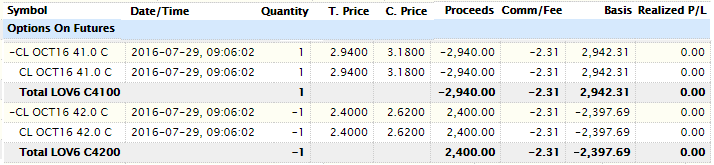

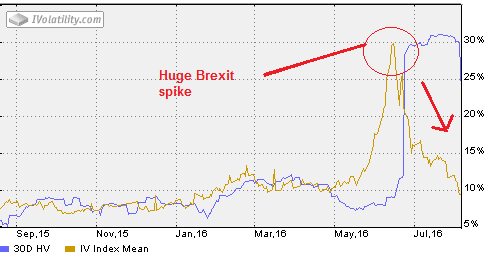

The charts below compares an European based Bitcoin fund SE:BITCOIN.XBT (as a proxy for Bitcoin spot price) with GBTC. This clearly shows that throughout 2017 people have been prepared to pay a huge premium to own bitcoin in their US based brokerage account.

GBTC Feb 2018 1 year trailing premium

GBTC Feb 2018 3 month trailing premium

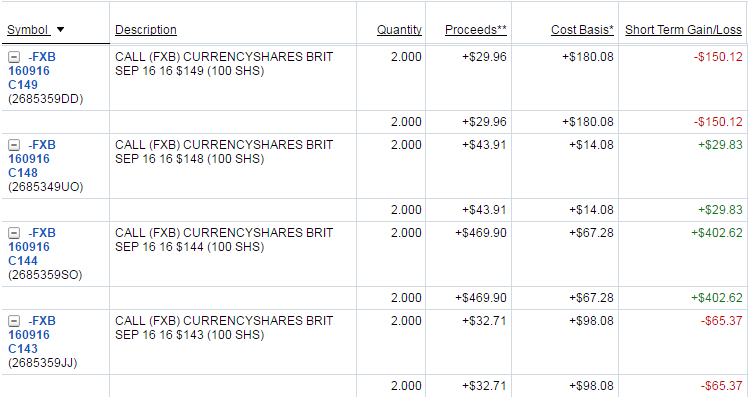

Combined with bullish Bitcoin 2017 price action and inflated premium, the GBTC price has moved up strongly. The above charts and Bloomberg show how the GBTC premium has moved for the last 12 months in a trading range of 50% to 120%. In only the last 3 months the GBTC premium has been as high as 120% in Dec 2017 and low as 30% in early Feb 2018. The premium trades aggressively higher on rallies and lower on sell offs. This behaviour has the effect of amplifying trading extremes, but increasingly makes it a less reliable buy and hold product.

As a recap, when the trade was entered in March 2017 GBTC premium had shrunk down to about 8% because there was the belief that a new Winklevoss Twins bitcoin ETF was about to be allowed by SEC. Once that was announcement was negative, the GBTC premium returned with a vengeance.

According to Bloomberg the average trailing 12 month GBTC premium was 53% (on 16th Feb 2017). By comparison the Bitcoin tracker fund premium was 0.08%. Additionally there is a 2.0% management fee associated with GBTC which is used to help manage the cold storage and security of the underlying bitcoin asset – so any premium paid on the actual GBTC spot price would seem to be excessive. The Bitcoin tracker fund management fee is 2.5% (higher) but since it trades at only 0.08% premium to NAV it is a relative “bargain”.

On 16th Feb 2017 GBTC had a 1 year performance return of 1,574.75% that more than double the Bitcoin tracker fund 1 year return of 774.33%. This is amazing given that the stated aim of the products is identical – the GBTC out performance results are exclusively due to premium.

For reference here are the Bitcoin and Ethereum products available that trade in Europe but can be traded in a US based brokerage account. These products do not have a huge premium to spot bitcoin and are IRA eligible. Bizarrely the swedish Krona product has the higher volume, over the Euro based product. All of these fund products introduce some currency risk exposure, but that is likely less to be way less variable than the GBTC premium risk.

| Coin | Currency | Info |

|---|---|---|

| Bitcoin | Swedish Krona | COINXBT:SS |

| Bitcoin | Euro | COINXBE:SS |

| Ethereum | Swedish Krona | COINXBE:SS |

| Ethereum | Euro | COINETHE:SS |

A Good Trade but Poorly Traded

This GBTC trade was ultimately a great investment, but one that was traded frustratingly poorly.

A small tranche was sold in May 2017 to cover the risk on the original position and the rest was left to run as “house money”. Clearly with hindsight that was the “wrong” thing to do, but is it good risk management on a very volatile product – and allows staying in the trade for a much longer amount of time. This risk management part was not poor trading, but the management of the resulting price action in 2017 can be improved – as discussed below.

The final run up into Dec 2017 was not well traded, and therefore missed the significant peak at $39, and survived the drop to $10 in Feb 2017, so decided to exit with some value still intact at $18. This is a very hard trade to take psychologically because of the anchoring to the high point at $39. However the 1300% returns in less than a year is still amazing, yet disappointing from a trading perspective. The split adjusted entry point was $1.44 so clearly this was all “house money” but some exit trading at higher prices should have been achieved into the Dec 2017 peak. This is not purely hindsight – it was clear the short term nature of the blow off top, even during Dec 2017. This does not mean the end of the bitcoin “bubble” – just a medium term trading top that should have been taken advantage of.

Bitcoin Investment Trust premium – Trade Exit

GBTC premium expands on rallies (up to 120% in Dec 2017) and contracts on huge sell offs (down to 30% in early Feb 2017). On trade exit at about $18 that is approximately an average 80% premium, which is somewhere in the middle of the range extremes for the last year. On trade exit with bitcoin at approximately $10k, the book value (or NAV) of GBTC was about $10, therefore there is approximately $8 of premium to nav (or about 80%). Therefore about 1800 shares of GBTC buys approximately one bitcoin, but the book value is about 1000 shares. Clearly there is a convenience premium, but 80% over book value is very high. That does not mean GBTC price cannot rise further, or the premium increase more in 2018. However if the premium ever shrinks to say 30% then it is quite possible to lose money in GBTC even if the bitcoin price goes up. When you buy GBTC at $18 about 45% of your purchase is premium (or “fluff”) over the price of the underlying bitcoin. That is a very hefty premium to spot.

Trade Entry was at GBTC split adjusted $1.44 (actual pre split price at that time was $131) in March 2017 when bitcoin was approximately $1250. Trade exit was $17.96 when bitcoin was about $10025 in Feb 2018.

Trade Replacement

The GBTC investment can be replicated without premium using the Bitcoin tracker funds. Since 1000 shares of GBTC represents approximately 1 Bitcoin, these trading approaches could be taken:

1. Sell 1000 shares of GBTC ($18,000 USD) and purchase $10k Bitcoin tracker fund – this maintains exactly 1 Bitcoin exposure. The remaining $8000 premium can be maintained as cash for future purchases if there is a pull back or for other investments. This maintains bitcoin only exposure.

2. Sell 1000 GBTC then purchase $10k Bitcoin tracker fund and $8k Etheruem tracker fund. This gives exactly 1 Bitcoin exposure but allows using the GBTC premium to buy a new Etheruem position. This has created a slightly more diversified crypto portfolio – but still fully invested in crypto, with no cash on hand.

3. Sell 1000 GBTC then purchase $6k Bitcoin tracker, $6 Etheruem, and keep $6k cash. This gives a less aggressive portfolio because it keeps some cash on hand in case of a pull back.

4. Sell GBTC and maintain cash to wait for a big pullback to invest. If you are a believer in the long term crypto currency bull, this is arguably the biggest opportunity risk – crypto prices are hard to predict and can be notoriously bubbly – so it having exited once at lower prices it is hard to reestablish at significantly higher prices.

These reallocation strategies are all tax optimal in an IRA.

Summary

There is a significant chance that if there is a bullish BTC price march in 2018 towards $20k again then GBTC will do very well. Indeed one day later BTC is already trading 10% higher at $11,000 (so clearly this is proving a badly timed exit). However there need to be discipline to recognize when that the GBTC trade now has premium risk outside of just Bitcoin spot price risk. That risk can be resolved by selling GBTC and buying bitcoin tracker funds.

This is not necessarily a price extreme for bitcoin, but a potentially a premium extreme in GBTC. Still bullish on bitcoin and crypto assets for the next few years, however GBTC may not prove to be a good long term buy and hold product (due to the premium).

In summary this is not purely a bitcoin play, but has become a play on the premium investors are prepared to assign for the convenience of exchange traded bitcoin product. Importantly selling GBTC is a not a bearish call on bitcoin or crypto in general, just trying to avoid being the last one out when playing musical chairs with the premium trade.