This is a bitcoin investment trust premium idea from seekingalpha.com we have taken a position in last Friday.

Investment Setup

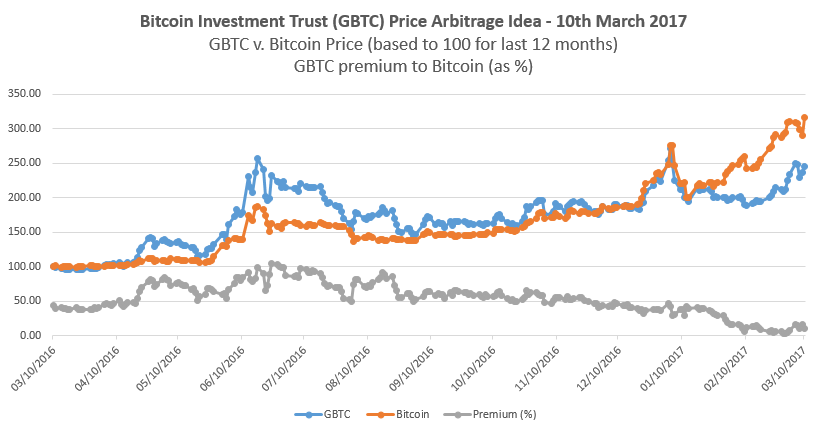

GBTC is an investment trust whose price is tied to bitcoin, with an extreme caveat that historically it has traded as sometimes astronomical premiums to the actual bitcoin price. The chart below clearly shows people have been prepared to pay a huge premium to own bitcoin in their brokerage account.

The chart is not easily available online. It had to be created manually by downloading the time series for GBTC prices and bitcoin prices, then working out the “premium other NAV” between them. When this was done both the GBTC & bitcoin prices were indexed back to 100, and the “premium over NAV” was plotted on the same Excel chart. Note that each individual GBTC share represents 0.09336483 of a Bitcoin (BTC) – so that ratio need to be accounted for when calculating the premium.

These are some highlights from the chart:

– GBTC premium to bitcoin price has been as high as 100% down to 5% in last 12 months

– GBTC was trading at a significant premium (70% to 100% range) to actual bitcoin price in June/July 2016

– GBTC is now only trading as about a 5% to 10% to bitcoin price in March 2017

– This premium has trended lower in last 2 months in anticipation of new Winklevoss bitcoin ETF (COIN) getting SEC approval.

Short Term Investment Thesis

– If bitcoin ETF (COIN) is approved, then this premium should be reduced further – but GBTC price will rise due to bitcoin price

– If bitcoin ETF (COIN) is not approved, then premium should revert to 30% range & GBTC price should increase to reflect that

– Absent a huge bitcoin crash this should be a winning scenario in either case

Medium Term Investment Thesis

– Bitcoin is stable above $1000 for 2017

– Historical 30% premium to bitcoin price is restored, because there is no longer a viable pending Bitcoin ETF that would compete with GBTC.

– GBTC has applied to be listed on the NYSEARCA which is pending a decision by Oct 2017. It currently trades on OCTBB and if it moves off the bulletin board this should improve product liquidity and investor access. GBTC premium might trend up in anticipation of this a few months out from the announcement (something to watch).

Bitcoin Investment Trust premium – Trade Entry

Trade Entry was at GBTC $131 on Friday when bitcoin was approximately $1250. Trade exit would be when a the premium is restored to typical range greater than 30% – but we have to wait 30 days to exit due to 30 day rule.

2 thoughts on “Bitcoin Investment Trust Premium”