Yet another Brexit trade! This is an interesting medium term trade idea – betting that the current hype around June 23rd Brexit poll in the UK is overstated. For the record personally don’t think that United Kingdom (uk) would vote for an eu exit. However there was a poll last Friday that had the leave campaign 10 points ahead.

Therefore due to the perceived risk of an exit the pound and stock markets sold off. Happily for our proposed trading strategy the implied volatility of the options has gone through the roof.

Typically on average implied volatility on options is overstated – and especially for know binary events (like stock earnings or polls). Therefore is makes sense to look at selling options, however with a potential huge move in event of a leave down you would not want to have unlimited risk. The aim is to “safely” sell premium without being on the hook for significant out sized moves of unknown magnitude.

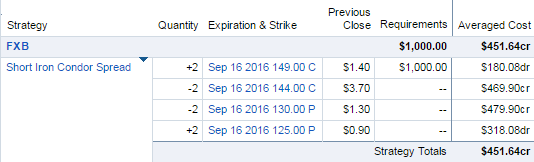

The trade is do a longer term iron condor in FXB options. The only option cycles that are more than 30 days out and available this week are July 2016 (32 days) and Sept 2016 (90 days). Therefore we will pick Sept 2016 (90 days). This is the trade entered on June 15th:

There is still time to do a similar Brexit trade before Jun 23rd this week, as the option will likely remain highly bid up in price into the announcement.

Typically with a 30 day rule would like to give ourselves some wiggle room to exit the trade after the 30 day period has elapsed. This typically means a minimum of a couple of weeks after 30 day period to allow a strategic exit.

Is it possible to do options with only (for example) 32 days to option expiration, but then you have only 2 days at the end for trade exit and you end up very close to option expiration where the gamma risk is very high. We could wait for August 2016 cycle to appear after this June 17th option expiration, but we’d like to get trade on this week as implied volatility looks quite rich.

This Brexit trade is focused on the markets expectation of big move on the announcement itself. The assumption is that result is “stay” (status quo) and that after the announcement the implied volatility of the options reduces and the pound ultimately settles in a range after the announcement. It is important to recognise that the trade could instantly lose money on the announcement but this is capped due to the limited risk nature of an iron condor. There could be a lot of movement in the spread but the bet is that over about 30 days the pins will be in a similar trading range between 1.30 on down side and 1.46 on up side. If there is a sustained violent move in either direction this trade will lose. However according to option pricing on order entry it is has 60% probability of finishing inside the defined range by option expiration, so probability is higher to take a profit at some point during the trade lifecycle. After 30 days and up to 90 days it could move around inside the range if volatility collapses after the announcement as expected it could make money even if it trades outside the range, due to lower option premiums due a volatility crush. There are a lot of variables that make taking a profit on the trade a possibility between now and September.

Brexit Trade – Possible adjustments

Given that this has 90 days to option expiration there are plenty of opportunities to adjust. Typically this would be selling more premium to improve credit received. Even if the trade moved slightly outside the range, sometimes adjustments can be made. This would usually be done by turning the untested side into a butterfly, then selling a vertical close to the money to bring in more option credit. For example if FXB move rapidly upward this what we would do for our trade:

1) purchase a new cheap put vertical otm (to neuralise any downside risk from the existing short put spread).

2) sell a put spread closer to the money to bring in more credit.

This would increase the credit received AND make the trade initially more price direction neutral.

However given that this Brexit trade is limited risk reward it does not HAVE to be adjusted. If goes massively against us initially on the announcement we may have to be content with taking close to max loss. in a very extreme directional move (either way) sometimes there is no good adjustment with an iron condor. Therefore there is some risk that can’t be predicted, however is it limited to the known max loss on trade entry – as long as you are comfortable with the initial risk you shouldn’t have to worry too much about this trade over the actual announcement.

Brexit Trade – Trade Entry – Wednesday June 15th

FXB options are pretty lightly traded and typically have low volume and open interest. Trade entry is always extremely important to the overall iron condor strategy, but very important in more illiquid products. The best strategy is not to rush into getting filled as soon as possible – the trade duration is 90 days so the iron condor pricing will typically not move that significantly in one trading day on options that are that far out in time.

It is very important not to use a market order for this trade because you will get killed on the execution price. A good approach is use a day limit order to enter the iron condor, then cancel and correct if multiple times to get close to best available price. One of the interesting things we have noticed getting filled on illiquid options is that sometimes you can fills above what is considered fair mid price. So it is a good idea to start about 10% over fair value and work down in $0.01 or $0.02 increments. For example of the mid point credit offered is $4.00, start at $4.40 and work down towards $4.00, then keep adjusting down until you get filled. When you get close to mid price and the order hasn’t filled yet, you can leave an order in there for a few minutes to see if it will fill. If it doesn’t fill then just cancel and correct it again for a slightly lower credit. If it doesn’t fill, repeat for a lower credit. Obviously you don’t want to take all day to get the trade done. However in the long run it pays not to be too impatient with this approach, because over multiple trades the savings will add up.

The following is a general trading tip that admittedly only have our own experience to go on, but seems to hold true so far. We have noticed that option spreads in these less liquid currency ETF spreads (like FXB) tend to be a bit wider on the open between 9.30 and 9.45 and the close between 3.45 and 4. The guess is that market makers in these currency ETFs would like to get paid a bit more for hedging the illiquid option risk, especially overnight currency moves are digested. So it is typically easier to get slightly tighter fills on iron condors between 10am and 3pm, and we like to use 11.30 to 1pm (NY lunchtime) because on average the market seems slightly quieter.

Brexit Trade – Profit targets

After 30 days in this Brexit trade is reached we can start looking at profit targets. Typically would look to buy to close the entire iron condor by entered a good til cancelled limit order – that will get triggered at say $2. That would give about $2 profit. Even after 30 days the options will still have about 60 days to option expiration, so this is primarily playing a volatility collapse, not time premium decay. The volatility will likely collapse after the announcement so option premium should decrease significantly.

Brexit Trade update – Monday June 20th

Option volatility reduced on Monday as the market perceives that Brexit is less likely. Risk assets (equities) rallied an fear assets (precious metals) declined assuming that a “Remain” vote was priced in. Additionally the pound rallied 2% against the dollar. The lower option premium makes this trade less interesting now than last week. But interestingly the option volatility adjusted down significantly before the announcement (not on the announcement as we initially anticipated). However volatility could pick again after the announcement, but it is most likely to reduce significantly from current 25% implied volatility towards the last years average of about 10%. If this predicted option implied volatility collapse occurs it will help out our trade (even if the actual price moves against us).