Futures are very large principal products and the underlying value of a single futures contract can be anywhere from $23,000 for natural gas /NG and up to $160,000 for US Treasuries /ZB. This means that for many accounts trading them is prohibitively expensive. However fortunately there are options on these underlying futures, that provide a good amount of leverage. Using futures options it is possible to create trades that only risk a hundred dollars or less to make a few hundred dollars or more. These can have a risk reward of for example 1 to 3 (risk $100 with max profit of $300). This means that you can easily construct trades to work within a portfolio of smaller size for example $50,000. using futures options also allows you to benefit from time decay and also high implied volatility on the underlying (similar to standard equity options). this gives you a lot more flexibility than just trading the futures out right long or short.

Having a 30 day rule means that you have to have some accommodation for exactly how you trade these products. They have to be traded at a size where you’re comfortable holding the position for 30 days without adjustment and also you have to make sure that you will be able to manage any market moves along the way without over extending your account.

For with the 30 day rule it is typically not a good idea to trade unlimited risk option strategies due to the difficulty in adjusting with the 30 day rule when the trade goes against you. Typically it is better to use limited risk reward strategies and let the probabilities of the trade play out over the generation of the trade rather than trying to adjust the trade significantly along the way. There are some trades where adjustments that can be made, but they always need to make sure that those new option legs can also be held for 30 days. For a primer on what the 30 Day rule actually is read this 30 day rule first. This post is an example of how to execute using the 30 day rule this with a futures option trade. (BTW – The trading principles can be applied even if you don’t trade with any holding restrictions, so you can still get something out of this trading approach).

To trade futures options in a small size, we will use the following process to identify the trade idea, then the futures and futures options to trade, then the trade entry and exit strategy. This example uses a Gold /GC bull call spread, but the strategy can be applied to many underlying futures products.

Trade Idea

Due to market anticipation of favorable gold news the price will rise up until the FED meeting announcement on Wed 27th Jan 2016. The key word here is anticipation and as this trade is attempting to “buy the rumour, sell the news” we would like to remove the FED meeting risk from the trade just before the announcement (more on exactly how that is achieved later when discussing trade exit).

Underlying Product

Example: Gold /GC

Gold futures are very liquid to trade, so make a good product for this trade idea. Note that could easily have used the underlying equity equilvalent Gold ETF (GLD) for this trade, but we are experimenting with the Futures in this example.

Gold futures are similar to trading equity (such as GLD) in that you make or lose money in a linear way, that if gold goes up/down by $1 you make/lose the same amount. However the critical different is that futures have an expiration date, whereas equity can be held forever. You can always “roll” to the next month with futures (e.g. replace a soon expiring Feb 2016 future with a longer dated Dec 2016 future), but you dont typically buy and hold exactly the same futures contract for a number of years. As long as you remember this it is not usually a problem, but you have to remember to pay more attention to your positions when trading futures.

Underlying Future

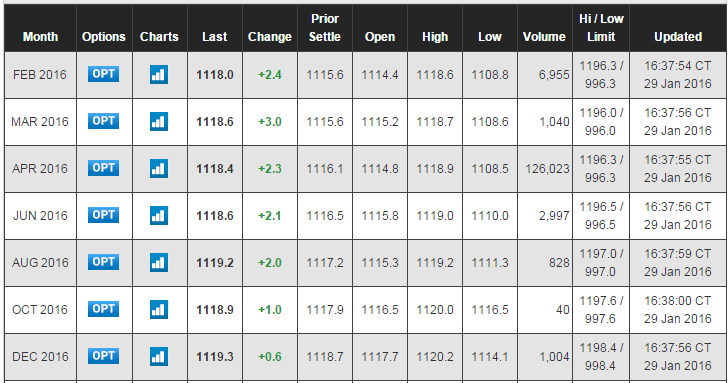

A Gold futures contract is an enforced contract to buy or sell 100 troy ounces of Gold at a given date in the future. Gold futures have many different expirations, that all trade at different prices. They are literally the currently expected future market price of gold at different dates (hence futures :-). Here is a snapshot of current Gold /GC prices for 2016:

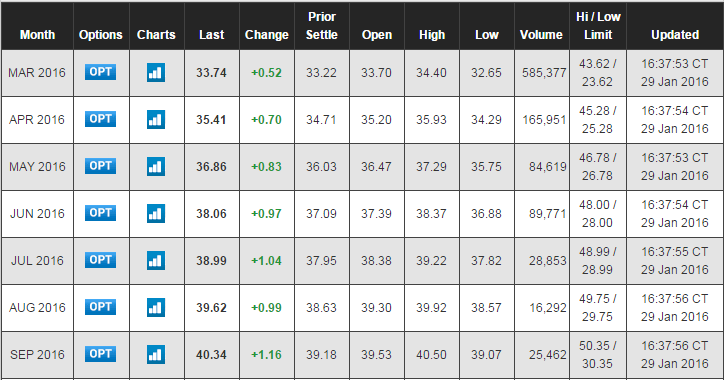

Notice that Gold /GC prices above only have narrow price range across 2016 (from $1118 to $1119). However this is not always the case for all futures, for example the crude oil /CL futures shown below a significantly wider price range (from $33 to $40). Here is a snapshot of current crude oil /CL futures prices for 2016:

This is very important for trading options on futures contracts, as the ATM option is a different strike in each future. Therefore it is critically important to know exactly which underlying future contract your trade was placed on, and monitor the correct price! This will avoid you getting confused later on by accidentally looking at the wrong underlying future when valuing your futures option trade.

We will use the April 2016 Gold /GC contract that expires on April 27th 2016 (Underlying: GCJ6 APR 27 ’16 FUT).

This gives us more than 90 calendar days before expiration, so plenty of time to make adjustments with the 30 day rule.

Option expiration cycle on underlying future

Now we have decided to use April 2016 Gold /GC future, we need to look up the available options that can trade that future.

Option chains that trade on that future have expiration dates of Feb 24th 2016 or Mar 28th 2016. We will choose the Mar 28th 2016 option chains to give us 60 calendar days before expiration, so still enough time to make adjustments

Note that we need to be aware of two expiration dates – 1) the future expiration date (90 days out) and 2) the expiration date of the options on that future (60 days out).

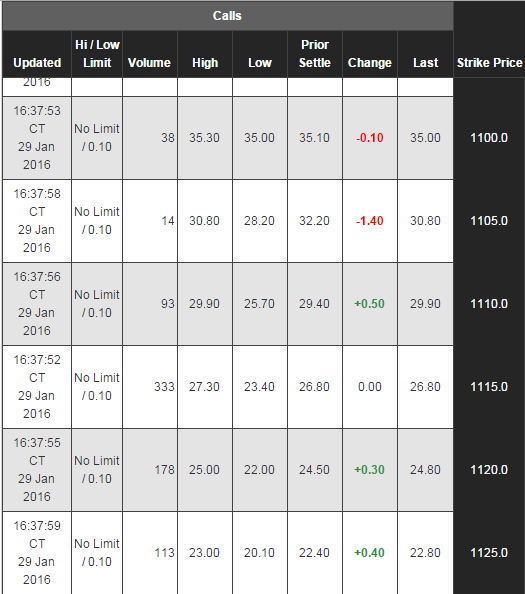

The following gives a snapshot of the Mar 28th 2016 Call options on the April 2016 Gold /GC futures:

(snapshot taken on 29th Jan 2016)

Trade entry

Using an ATM vertical call spread, gives an initial delta of 5, which means that for every $1 move in the underlying Gold /GC contract you would make or lose $5.

Trading the ATM call spread means that most of the trade is intrinsic value (not paying for time premium). Therefore the implied volatility of the underlying options is less important.

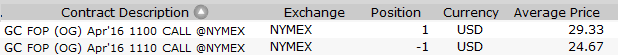

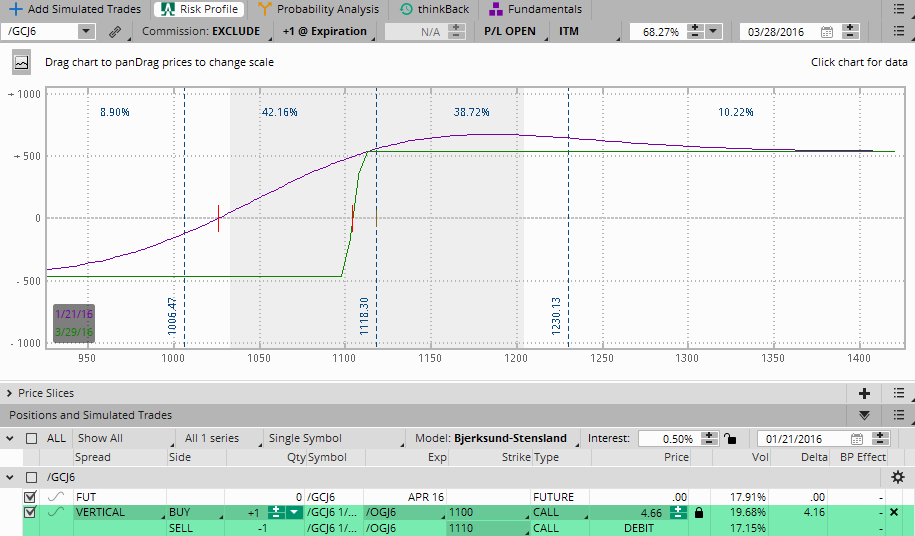

The trade was entered on Jan 21st with a $4.66 debit (or $466) when GCJ6 APR 27 ’16 FUT was at approximately $1105:

The following shows risk profile at trade entry:

Trade adjustment

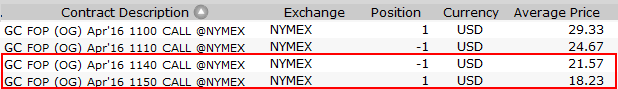

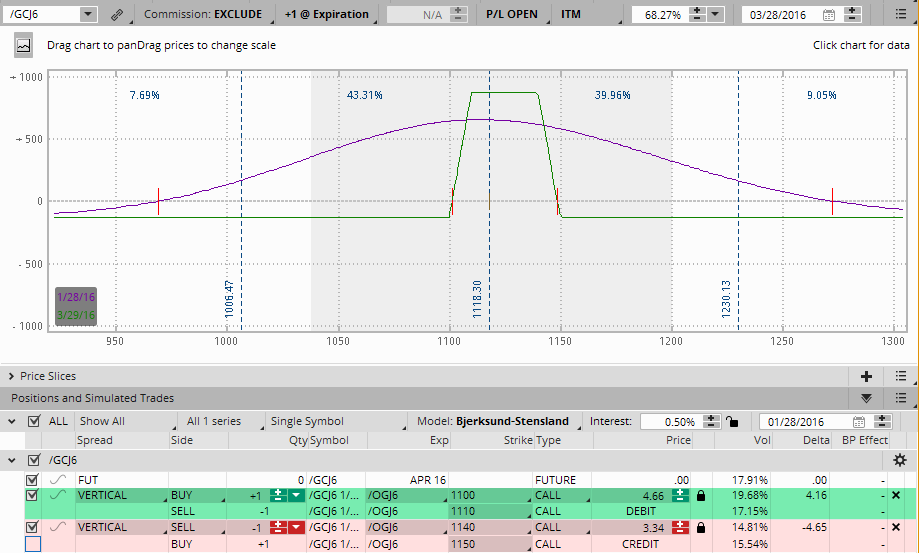

Just before the FED announcement, the price of Gold /GC has run up and so we will effectively cover the majority of the trade risk. This is done by converting the entire structure to a butterfly, by simply adding an OTM bear call spread.

The spread is OTM, so all of it is extrinsic (i.e. time) value. Trading the OTM call spread means that the higher the implied volatility of the underlying options, the more time premium is collected. Additionally selling the OTM bear call spread into a uptrending market just before a major FED announcement captures good time premium. The theory being that the anticipation is greater than the actual realised move after the FED announcement, and you in this case we are selling what everyone else is buying.

The trade was adjusted on Jan 26th with a $3.34 credit (or $334 credit).

The total trade risk is now only $132 ($466 debit – $334 credit) and has following risk profile after trade adjustment:

Trade exit

Re-evaluate trade in about 30 days time to see what happens. Since this is a now a butterfly trade, it has almost no directional risk and will benefit from either time decay and an implied volatility drop, assuming Gold /GC stays in a fairly wide range.