Using your actual savings rate can be a good way to determine what size an investment should be, if you are not sure “how much” is too much. Basically if this investment went to zero, how much time would I have to work to earn it back ?

This calculation assumes you have a job and you save money. If you get paid a bonus, you might want to include that in the calculations, but to be conservative this will just consider base salary numbers. To do this we need to look at some definitions:

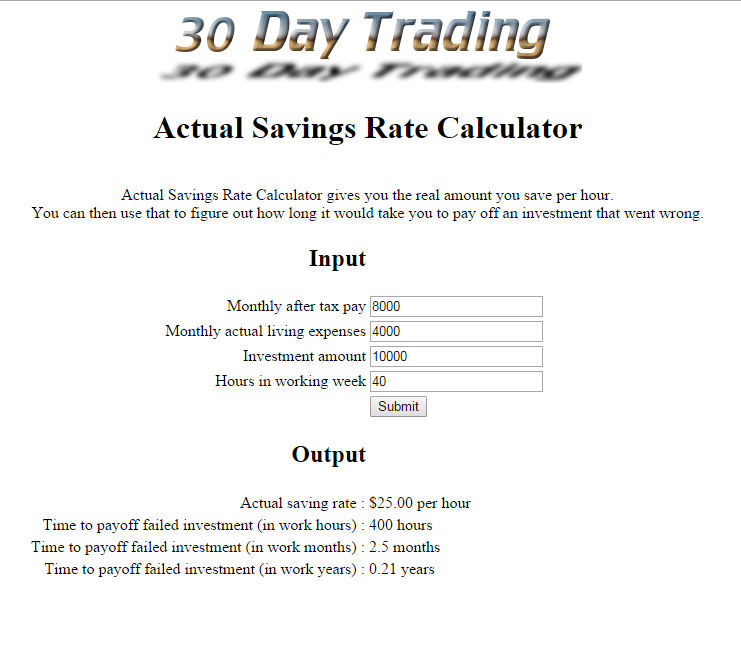

Monthly after tax pay – means the amount you get in your checking account every month after tax and everything else has been deducted. This will typically be pay that has had the following removed: federal tax, state tax, 401k contributions, health care premiums and commuter benefits. Furthermore we will assume that retirement savings like 401k contributions are not included in the calculations, because we are trying to deal with our after tax pay rate. Obviously 401k contributions are “savings” but the idea is to try to come up with calculations that work with month to month after tax pay, effectively your real working monthly budget of “money coming in”. Lets assume this is $8000 a month.

Monthly actual living expenses – means everything in your budget you need to live in an average month – including housing, food, entertainment, travel (etc) – basically everything. The monthly amount will move around in some months (for example if you pay for a holiday) but a decent start is to calculate use last year’s total living expenses (divided by 12). Lets assume this is $4000 a month.

Actual saving rate – this is all of your after tax income minus your monthly expenses. Therefore using the above examples that would be $8000 (income) – $4000 (expenses) = $4000. Assuming a 40 hour work week, this means your actual savings are $1000 a week, $200 a day or $25 per hour.

Time to payoff If you lost the entire investment, how long would it take you work to “pay off” the loss? For example, if you invested and lost $10,000 it would take you approximately 10 weeks of 40 hours (or 2 and a half months work to pay it off).

You can access the Actual Savings Rate calculator and below is a screenshot of the calculator with these values:

Consider another more extreme example. If you have been fortunate enough to accumulate a $1 million portfolio, we could use a very simplistic “worse case scenario” giving a 50% haircut to $500,000. Using the $25 per hour work rate (from above) it would take you approximately 20,000 work hours or 9.6 years to pay that off. Just think about that in relation to your existing stash, particularly if has been allocated into one strategy like a Modern Portfolio Theory asset allocated portfolio.

Very few standard financial risk assessments look at the individual work time required for this “replacement risk” of earning back lost money. They typically include only a before tax salary number and a percentage saved of that salary – which as we’ve discussed previously it is not that useful a number.

Understanding your risk along the way at all points in your portfolio life time, from starting working to almost finishing. Don’t simply buy the usual argument that risk in the early years “doesn’t matter” because you have time to make it all back. Now you can actually answer the question, how long is it going to take to earn all this back if it goes wrong ? You may now look at risk in a different way.