In the spirit of full disclosure on our option trading, this trade lost money. However it could have been significantly worse. The point of this post is to be honest about when things go wrong, and more importantly how to worm your way out of them to survive another day. These trades were all with the context of having a 30 day rule, but the principals can be applied to trading without those restrictions.

Trade Entry

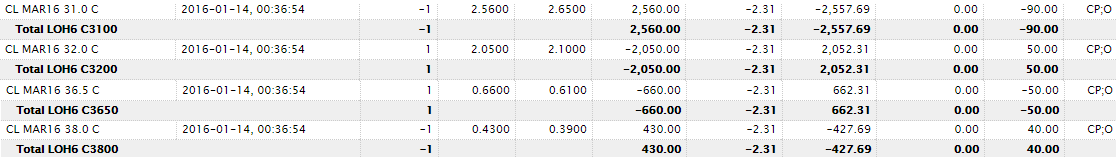

On 20th Dec 2015 entered into a crude oil /CL neutral strategy using an iron condor with about 60 DTE as follows:

2 Trade Adjustments

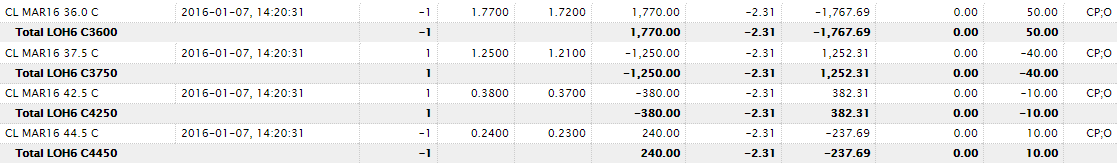

As the crude oil market sold off heavily in Jan 2016, the position was defended by adding 2 short call condor trades against the original iron condor position. A short call condor reduces the long delta in the original iron condor position. The first adjustment was to reduce long delta on 7th Jan 2016:

The untested short call spread cannot simply be rolled down because the original option position has not been open for more than 30 days, so that would clash with the 30 day rule. Therefore the short call spread closer to the money was added to create short delta (and reduce the long delta in the original position risk). The long call spread effectively is “cancelling” out the original short call spread, trying to simulate (as close as possible) exiting the original short call spread. Due to 30 day rule the same contract strike cannot be traded again within 30 days – so the new long call spread uses contract strikes that are only $0.50 either side of the original short call spread strikes.

Note that both of these adjustments need to be more than 30 DTE to avoid issues with the 30 day rule.

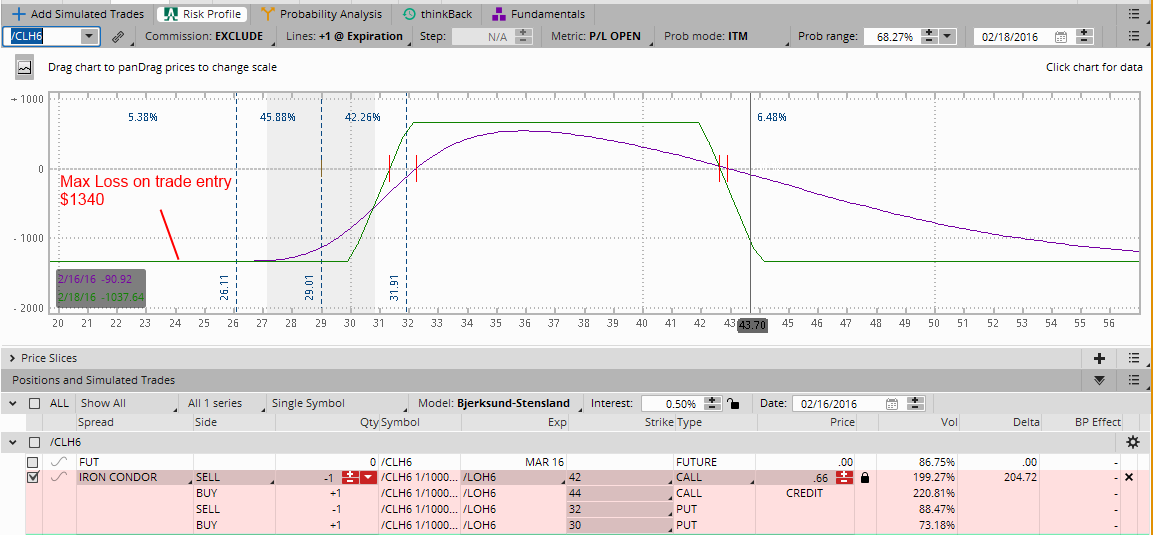

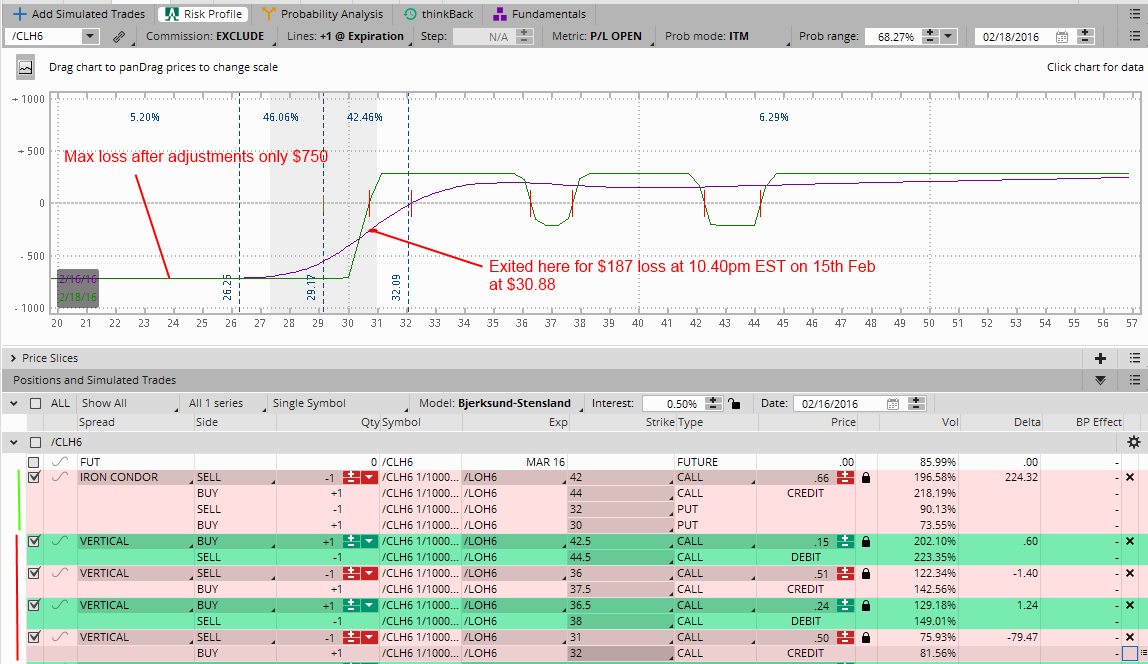

These adjustments changed the risk profile from a max loss of $1340 to $750:

Trade Exit

Crude Oil /CL price action was all over the place during the trade life cycle:

Although because of the reduced max loss, the trade could be held through big down move, ultimately exiting into a nice pop on Feb 15th as Asia opened.

Final Profit/Loss

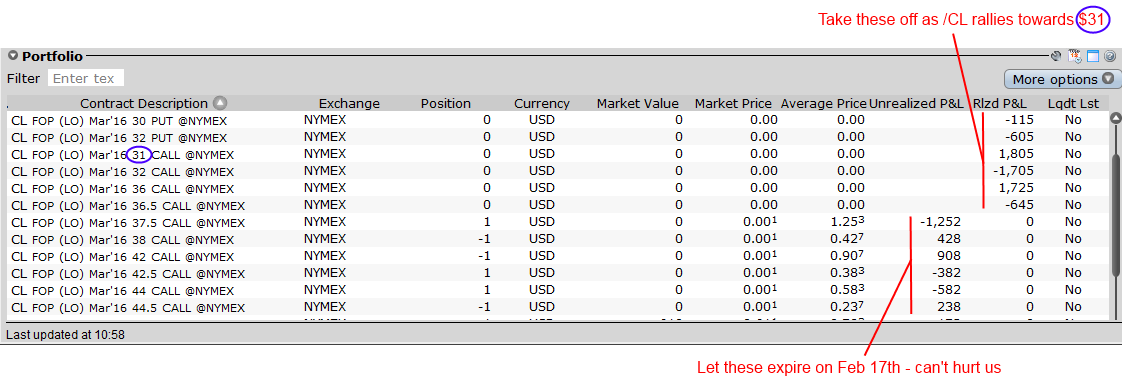

Admittedly trade ultimately lost $187 (see below) however the risk was managed using short call spreads (delta hedging) along the way.

This was a quick example of how to play defensively with a position, not just “hope it all turns out ok in the end”. The techniques can be applied to defend any similar positions. You can also learn something about option payoff diagrams and delta hedging, with a position that is going against you.

Importantly all option legs in the trade were traded as an entire position – we didn’t try to “leg” out of the individual option positions (that is time the market by exiting individual option legs separately). Given that approach, the entire position could not be exited until 15th Feb, because the latest trade adjustment was added on 14th Jan – so if we are going to trade the entire structure as one position then we were forced to wait at least 30 days from 14th Jan to exit.

In summary the ability to manage risk on trades that go wrong, is as important as having winning trades.