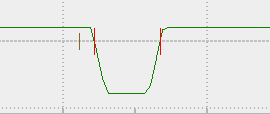

An Short Call Condor involves trading a total of 4 call options (selling 2 and buying 2) in the same expiration cycle. Selling one call while buying another call with a higher strike (short call spread) and buying one call and buying another call with an even higher strike (long call spread). This trade is only usually used to “defend” an existing position, it would not normally be started as a trade entry. This is because you can often lose a lot more than the credit received. This risk profile is good for playing defense when you want to just scratch an existing open position – but not typically a good risk/reward for a new trade in its own right. The payoff diagram is typically: