This outlines the investment thesis for starting and maintaining our long energy position in 2021. This is then followed by implementation of the short selling put strategy on XLE energy sector ETF. Selling XLE puts has been an effective strategy in the first half of 2021, however the year started with quite a bit of uncertainty in energy sector. Fortunately the uncertainty provided “fear” in the option premiums, so running a strategy that benefits from high volatility makes sense. Also covered is why some potential XLE trading strategies were rejected due to the higher volatility.

Pricing note: Unless otherwise stated XLE prices are weekly closing prices, not daily close or extreme high/lows intraday.

Investment Thesis

In the previous year 2020 there had already been one huge XLE sell off into the Covid crisis low, which was ultimately hit at $25.86 on 20th March 2020.

Then followed by a 5th June peak around $44.84 within 2.5 months. This was then followed with a steady fall back to $28.72 on 30th Oct 2020.

The year 2020 ended with a very steep 32% rally in the last two months, ultimately ending at $37.90 on 31st Dec 2020. XLE was trending bullish or bearish in either direction for a few months, but then would reverse direction and trend in the opposite way for a few months. This meant that the energy outlook was somewhat uncertain – specifically investors were taken by surprise with Oct 2020 nearly revisiting the March covid low. This 5 year chart shows the context:

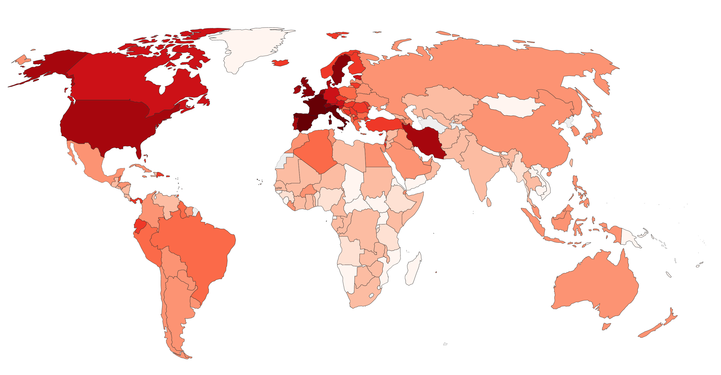

On a multi decade chart XLE is also at the bottom of the trading range. The main bearish case for oil producers in the energy sector is that fossil fuels are a dying industry that is destined to be replaced by alternative energy such as wind or solar. This maybe true on a 10 to 20 year time horizon looking towards 2030 and 2040. However energy is cheaper enough on an absolute basis to take a tradable medium term 2 to 5 years position. XLE is trading at the same price as 15 years ago – obviously XLE has paid significant dividends since 2005 so that isn’t a zero percent return – but it is clearly “cheap” based on historical pricing.

Obviously looking at price only does not necessarily make a sector relative good value, so looking at historical price to earnings ratio is another well used metric. One such price to earnings ratio is the Cyclically Adjusted Price-to-Earnings or CAPE for short. CAPE is defined as a valuation measure that uses real earnings per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle. Looking at the energy sector CAPE shows relatively cheap valuation in 2020 with two annual reading of around 11 (18.42), rebounding to 18.42 as of first half of 2021. This is significantly cheaper than all other S&P sectors in the table below.

Also the percentage of energy sector in the S&P 500 is 2.53% as of July 2020. This will have increased in 2021 due to energy sector rally, but the percentage size compared to other sectors is still historically low. This reflects the energy sector issues, but is small enough allocation that if only some investor capital flows back into energy the sector could grow quickly. This is not an argument for it returning to 20% of the S & P 500 – only that an investor sentiment could see it rally quickly because it’s absolute base is relatively low.

For the full sector chart with all sector percentages – see visual capitalist .

Trading Strategy

All of this historical bearish price action did generate some good option premiums to sell into 2021. Even though XLE has been rallying in 2021, volatility has been high due to the constant threat of a significant sell off.

For other trading positions we’d often use deep in the money LEAP calls and selling shorter term calls to start a new position. That trading strategy often works best on growth stocks or commodities with zero dividends. However XLE isn’t currently a great candidate for that because of the dividend yield, and higher volatility on the long term LEAP calls. Other option trading considerations come into play with higher dividend stocks like XLE – stocks that don’t pay dividends have less chance of having ITM short calls being exercised on you as the contract owner takes the stock to capture dividends. Also overpaying for longer term LEAP calls in high volatility can be a problem if they were purchased with a lot of time value. Generally it is better to start the deep in the money LEAP and overwriting when volatility is lower. XLE isn’t currently a great candidate for that because of the dividend yield, and higher volatility on the long term LEAP calls.

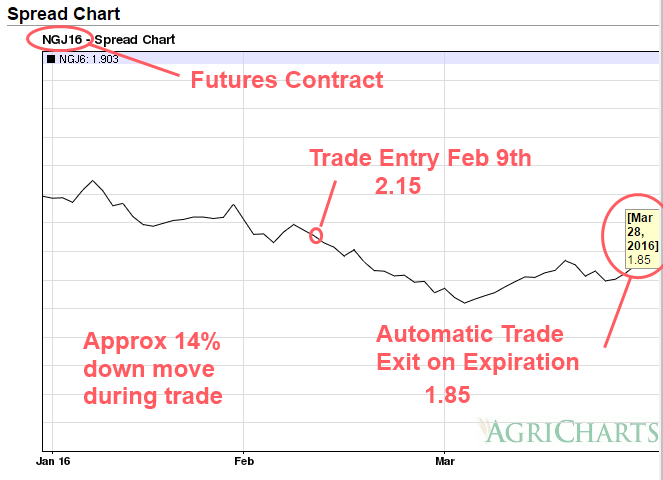

Due the significant sell off XLE had a dividend in 2020 that moved around in the 4% to 5% range depending on price extremes – so buying the stock outright or selling puts to capture the dividend looked like a good approach. Since the energy sector was in play so much, put option premiums generate some significant put premium volatility. Given the combination of high volatility and excellent dividends, selling put options seemed like the best choice. See this historical volatility chart for the trailing 12 months from July 2020 to July 2021, showing the significant volatility spikes in first half of 2021:

It’s hard to time perfectly, but selling puts should generate monthly premium, and worse case secure a stock position in high dividend stock. The risk of selling puts at lower prices (on stock that you want to own long term) is that XLE runs away to the upside too fast, and the opportunity to own stock at a good yield is gone. Ideally would like avoid XLE running away to the upside and having to chase the market to “avoid missing out”. The ideal market for selling puts is one with a bullish or flat bias, with high option premium. Over a number of months, this is a balancing act to sell without the probability of being assigned. Part of the art is to sell options at higher and higher strikes every month, but not so high that when the market reverses at the top all profit is given back on one “bad” put. Selling put with XLE in the range of $40 to $48 out 45 to 60 days to expiration was done in early months of 2021 – but as the market went over $50 the strategy reverted to longer dated 90 day options at strikes in the $45 to $48 range. No put option was ever sold over $48 even though the market went as high as $55.

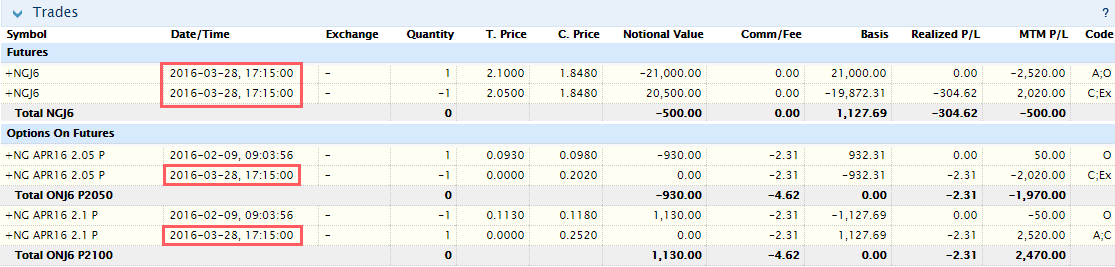

The red lines on the chart below show where the puts were sold. The start of a line is an opening position (sell to open), the end of a line is a closing position (buy to close) and the price level of the line gives the $ strike. Shorter lines indicate holding periods of 30 to 45 days, and longer lines indicate 60 to 90 days.

Each red line is trade of 10 contracts. Sometimes the risk was tripled up, with a maximum risk of 3 x 10 contracts = 30 contracts. During April 2021 there was theoretically a risk of ($45 x 10 contracts) + ($46 x 10 contracts) ($48 x 10 contracts) of about $139k (minus put premiums sold).However this was only done in rising markets when the older puts were nearly worthless. There was a theoretical risk of 30 contracts, but looking at probabilities the $45 and $46 strikes only had a delta of less than 10 (so had a greater than 90% of expiring out of the money). Also if the market suddenly turned very quickly they could simply be bought back to reduce risk. If there was a flash crash (e.g. a daily move from $50 to $40) then all 30 contracts would have gone in the money – but that volatility was unlikely according to the options pricing. A flash crash “could” have happened but it seemed worth the risk, as it was a very low probability event and the trade was working.

Although at the end of April the final put did get closer to assignment and the market was now trending down. Therefore made the trading decision to go back to 10 contracts only (1 red line) and keep further out of the money. There were still some decent premiums to be had into May because of the increased volatility. As XLE moved higher into May and June moved some of the strikes up because the market was trending upwards, and was ok to double up contract exposure (have 2 red lines or 20 open contracts).

Ended up taking on more risk in a bullish market while the XLE trend was up, but pulling back contract size when XLE was moving down (due to rapid sell off risk). Importantly “risk” here is a relative concept compared to buying XLE outright. Most puts were sold with a 35 delta or lower – which means that on trade entry they have about a 2 in 3 chance (65% or higher) of expiring worthless (making money) at expiration. So they mathematically have an edge of winning each trade, and can typically tolerate at least a $2 to $3 XLE pullback without losing. There is risk here, but XLE has to surprise rapidly on the downside and there are adjustments that could be made should that happen. Worse case end up with a dividend paying stock at a reduce price.

The selling puts trading strategy does have issues if XLE is chased higher and puts are just sold mechanically without regard for price in low volatility. Option volatility tends to decrease in rising markets, so selling near month options at the top of multi month uptrend is not ideal. For example, selling shorter term 45 day to expiration put options at $55 on a market that has just gone from $45 to $55 in a month can be asking for trouble. If that option is sold in lower volatility for $1 but has to be bought back at $4 in the higher volatility of a declining market – then that is $3 of lost premiums. That could be giving back 3 months of premium profits in a few days. It’s not “free” money, it’s money for taking risk and always need to respect the market’s ability to reverse. Market tend to reverse faster than they increase (“stock take the stairs up, but the elevator down”) – which is why the short put premium exists in the first place. Or those who prefer a more dramatic interpretation from the 1800s can always quote “He who sells what isn’t his’n, Must buy it back or go to prison”. Technically short puts are cash secured, but the short selling warning still stands – selling more put contracts than you can cover can be painful.

Margin Requirements

The short put strategy can require keeping the entire cash amount available to cover the short put liability (should the stock be “put” on a price decline). In accounts such as an IRA that require a cash secured put the full amount of cash needs to be available. In a margin account you are still liable to buy the stock back – for example consider 10 short put contracts on XLE at $40 strike that expires in 45 days. If XLE went to $0 (zero) in 45 days you would be required to buy $40k stock. However a broker typically only requires about $8k to $10k margin for a 10 contract short put option in the price ranges of $40 to $50 – even though the theoretical value of the stock position is in the $40k to $50k. The exact margin calculation requirements will move daily with strike price and stock volatility. The return on margin is a fantastic investment return if run successfully each month e.g. For 10 short puts assume $10k margin to sell a $1 option held for 45 days. Assuming $1 option profit every time, and run it about 8 times a year (365 calendar days / 45 calendar day option holding period) and then dividing by the same $10k margin used every time = about 81% annual return on margin. Note that % annual return is theoretical maximum return assuming all puts expired worthless – achieving half of that would be an excellent trading year.

Trading Summary

In summary, selling XLE puts has worked well for last 7 months and using margin can help juice returns. The strategy worked well because XLE went up or sideways and energy markets still had high volatility. However it is important to manage the risk and respect the power of the market by not fighting significant down moves. Recognizing down trends and adjusting position size to reduce risk are important for selling puts. The current plan is to maintain this working trade for the rest of 2021, but could re-evaluate anytime.

Credits: Oilfield Pump (Texas) image used at the top of this page was created by Jcutrer photos. All other credits are referenced inline.