We are developing an online option backing test tool for “30 day trading”. This back tester allows you to interactively show the historical results for using monthly options to manage the risk of long term ownership of stocks or ETFs.

Currently the strategy back tester does historical back testing for the Collar strategy (long stock, short call 1 month out, long put 1 month out).

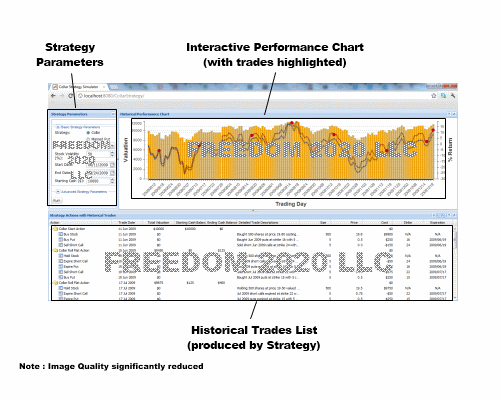

The “30 day trading” product prototype currently provides :

- Fully configurable set of strategy parameters (e.g. stock volatility, when to roll put options down etc)

- Performance chart comparing “strategy” performance (%) versus “buy and hold” performance (%)

- Full list of all trades the strategy executes, either on option expiration (or for rolling options)

- Actual historical prices for stock and option trades (not derived historical option prices)

“30 day trading” has a generic option trading strategy engine behind it, so can be extended to work with other similar strategies such as :

Married Put : long stock, long put 1 month out

Married Put : long stock, long put 6 months out

Married Put Vertical : long stock, long vertical put spread 1 month out

It could also be extended to included short call “income methods” such as vertical call spreads or 2:1 call ratio spreads.

“30 day trading” provides an interactive online view of back testing a strategy, giving a dynamic view of historical strategy performance. This is similar to the historical collar strategy results outlined in this optionseducation.org white paper (unaffiliated 3rd party research).

Would you be interested in trying out a live test demo of the product prototype ?

If so click here.

Please note: This demo works best in the latest versions of the Google Chrome and Firefox web browsers. It does not currently fully work in Internet Explorer (but it is planned to ultimately work on that platform).