In 2020 and early 2021 we have started what will hopefully be a multi year position trade in uranium stocks. A position trade is taking a significant portfolio % trade (up to 10%) on a high conviction trade idea, to hold for several months until the fundamental trend peaks. Commodity trading is notoriously hard to time, because often there are several years in the wilderness, followed by huge peaks in a few months or years, following by equally rapid declines. Therefore some level of trend following is required to avoid having capital tied up unproductively for years.

Trading Products

The uranium sector is relatively niche compared to commodity sectors like oil, natural gas or gold. Historically the uranium sector has been underserved by ETF products, and there are currently only three URA, URNM and NLR. Both URA and URNM are more direct play on the uranium commodity producers, versus NLR that also includes nuclear power related stocks.

NLR will be ignored for this position trade, because it focuses on nuclear industry conglomerates, utilities and only some uranium miners. It trades more like large cap equity and only requires that companies get 50% of their revenue from uranium sector.

URA has been in existence since 2010 and focuses on large and medium cap uranium producers. URNM started trading in Dec 2019 and seems to have been constructed to only allow strict uranium producers. However to achieve this allocation URNM has to hold significantly smaller cap uranium producers and penny stocks that might not make it into other ETFs. For example the 4th highest URNM holding Yellow Cake PLC only has a market cap of $400 million, and with a 8.9% allocation. This makes URNM a more pure play on uranium but will definitely make it more volatile. Some holdings that have less than 5% allocations are penny stocks and will trade accordingly (high peaks, low troughs etc). The URNM ETF allocation is ideal for Uranium producer exposure in one place, but need to understand what it contains and don’t be surprised if it moves very quickly up or down.

This is direct comparison of URA and URNM top ten holdings. 47% of URA is in the top 2 main sector heavyweight stocks, but for URNM this is only around 32%. The URNM holdings are less concentrated in the larger cap firms. URA and URNM also trades LEAP options but they seem to have wide bid/ask spreads, so it appears more efficient to trade the ETF directly.

Cameco (CCJ) is the major North American uranium producer. CCJ is widely covered in research in US and Canada and and is often used as a proxy for the uranium sector. In late 2020 and through out 2021 the sector has broken out above previous multi year resistance. The following chart compares 5 years of historical price performance for ETFs URNM, URA & NLR with Cameco (CCJ) stock. During the last 5 years URNM was listed in Dec 2019 but all others were already trading at least 5 years ago. The relative outperformance of URNM is due to it’s mix of pure uranium producers including penny stocks.

Completely separately there are actually CME traded Uranium futures but they appear very illiquid and don’t have any option liquidity. Logically futures would seem to be a good way to access the physical uranium market, but they seem to be not be actively traded in any time frame (from near month to one year out). Have not researched why this should be, because many other commodities actively trade on CME futures. Whatever the reason, uranium futures are not useful as a trading vehicle. Anyway if the commodity price increases then uranium producers equity should provide more upside leverage than physical uranium.

Uranium Worldwide

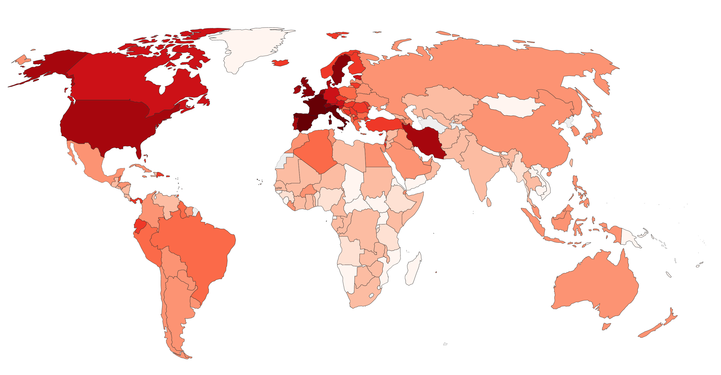

Uranium production takes place in many countries around the world, but has significant concentration in only a few countries. More than half of all identified uranium resources are from only 3 countries. Recoverable “identified resources” means reasonably assured Uranium resources in the ground, plus inferred resources from mine surveys. The following pie chart breakdowns the worldwide percentage of identified uranium resources by country:

Traditionally a commodity producing countries Australia have more than a quarter (28%) of world identified uranium resources. However less expected countries like Kazakhstan have major mines and account for 15% of uranium resources. Canada makes up rest of the top 3 countries with 9%. Many other countries make up the remaining half of uranium resources but always in decreasing percentages. The USA only accounts for 1% of world identified uranium resources.

New Uranium Trust

One very significant event in 2021 is the planned US listing by Sprott Asset Management of a new investment trust to own physical uranium. The uranium price has been accessible for 5 years in Canada on the Toronto exchange as Uranium Participation Corporation (TSX: U). However crucially Sprott’s plan is to buy UPC out and change the investment structure to allow a US listing – which will open it up to many investors portfolios.

Quoting mining-journal.com (with our italics) : “Industry commentators have suggested that Sprott’s market participation has the potential to transform uranium from a sleepy commodity whose consumers dip into an opaque spot market to supplement their long-term contracts, to a more liquid, transparent and easily investable sector for investors who want exposure to a commodity expected to face increasing demand.”

Sprott has already brought gold (PHYS) and silver (PSLV) to market, so has a good track record in the resource space. The current listing date for new Sprott uranium trust is July 19th 2021.

Uranium doesn’t traditionally have speculative investor demand in the same way as commodities like oil and gold. The spot uranium was historically hard to buy as an institutional or retail investor – either with futures or via a physical trust. Having US listed spot uranium trust could provide organic investment demand as an alternative asset diversifier. There is a large pool of investor funds sloshing around the world looking for returns, so it could land on uranium in the next few years.

The other important item with uranium companies is the relatively small market capitalization of the entire sector. The uranium sector’s current market capitalization is about $30 billion. Any significant in flows into uranium equities could result in this rising significantly. The combination of a new physical trust and equity in flows could translate into wider investor interest in the uranium sector.

Trading Update

The original URNM trade entry was in April 2020 on the rebound from the post covid crash, after the market had decided the world wasn’t ending. The URNM position trade strategy was simply long ETF with no options involved. The ETF spread was relatively wide, so trade entry required working some limit orders to get a decent price – but often URNM would still only fill very close to the ask. e.g. if the bid/ask from $27.65 / $28.00 would only fill at $27.95 even by walking up Buy limit orders in $0.01 increments. URNM is too illiquid to trade regularly.

In Jan 2021 the position was doing well (up about 57%), but did not believe that our position size was big enough for the trade conviction. One thing that we had noticed when analyzing trades from last 2 years (including 2019 and 2020 trades) is that generally not getting paid enough for being right – usually because the position sizing was too small for the portfolio. There were also around 20 to 30 distinct ideas and strategies that were not contributing enough to the bottom line. Decision was made to focus on only 10 to 15 ideas at a time for the trading account, which allows idea quality to improve. This also reduced the time monitoring active positions with the constraints of the day job. When getting significant macro calls correct we are attempting to increase size in 2021 to maximize returns. For example with “long oil in 2021” sometimes the “normal” position sizing was increased from 10 contracts up to 30 contracts. It’s a bit out of the comfort zone because the position sizes are 1 or 2 times bigger. However since we always maintain good risk management – the good calls are still beating the losers so far.

In the spirit of getting out the comfort zone on major trade ideas we decided to pyramid up with 2 extra purchases around $44 each in Jan 2021 to bring up with average price to $39. There was fairly clearly some institutional buying in the last couple of months of 2020. So although adding in Jan 2021 was late after the 30% run up, it appeared we were in good company. Having the initial position from April 2020 allowed us to enter a very bullish trend at full position risk, but still have a 10% downside cushion down to the new average price. The following chart shows where the greater risk was added and how the average purchase price moved up.

Summary

This URNM position trade also shows the importance of having some position in trade ideas you care about. Then you will care enough to monitor the position and not miss opportunities to add size. It can be hard to take a brand new position trade in a strongly bullish trending market – even if the trade conviction is high. This trade will be held long term in an IRA and potentially be a multi year hold.