This is a COVID-19 coronavirus portfolio of trading ideas generated in the last two months. The portfolio aim is to identify and invest in new trends in commodities or sector ETFs generated by either government policy monetary policy response or “shelter in place” lockdowns.

This collection of trading ideas was setup somewhat quickly as a tactical portfolio in response to the COVID-19 Corona Virus situation. The fundamental portfolio theme is that the market has been almost instantly split into winners and losers, Some industries have simply been decimated overnight that they can’t function as viable businesses for the immediate future. For example, even Warren Buffet completely sold all Berkshire Hathaway’s US airlines in April 2020. The aim of this tactical portfolio is to think about trading ideas that can generate winners in the “new normal”.

COVID-19 coronavirus portfolio – Option Volatility

Volatility is very high in most commodities and sectors, so it is critical to use option trading strategies for high volatility environments. Specifically Implied Volatility Rank (IVR) is in the range of 75% to 100% for many ETFs this month. Simple one leg option strategies such as buying out of the money calls in high volatility products will likely not do well. The “go to” trade on ETF options has typically been to buy long dated deep in the calls (LEAPs greater than 9 months out). This means that the majority of premium paid is intrinsic not extrinsic (time) value – the extrinsic value will likely reduce over the course of several months as the current volatility premium likely goes lower. To help with any downside, call spread overwriting and put butterflies on the same ETFs. There was also call spread overwriting in major tech indexes to hedge some downside in tech ETFs that do not have any options. Where no ETF options were available, actual ETF equity positions were taken, but sized appropriately at less than 10% of portfolio size.

COVID-19 coronavirus portfolio – Trade Ideas

The exact thinking behind the ideas need more detailed separate blog posts to fully justify their inclusion. However this tactical portfolio blog post is just to give the trade ideas, their high level implementation and any hedging strategy. This following ideas show the sector, idea rating (buy/hold/sell), the conviction level (low/medium/high) and a high level idea description.

New trades with “Buy” where started in the last 45 days. If a “Hold” is included in this portfolio that means it was already owned, but think performance would improve because of COVID-19 Corona Virus environment. The aim would be to hold most of these for 2020, or until stopped out.

Each paragraph describes a trade idea within a sector (including trade direction), rating (Buy/Hold/Sell) and overall conviction level.

Real Estate and Liquidity

Real Estate (Long). Hold/Buy. Medium. Select international opportunities mostly due to strong USD creating weaker local currencies and lower prices on local real estate. Here “local” means local to a target country in question, specifically Canada and UK whose currencies have been beaten up quite a bit due to flight to safety buying of USD. Keeping liquid in USD to maybe a currency conversion later in 2020 for a property purchase. Not rushing into anything. Actively writing a new Ebook for US investors on future opportunities with international real estate in 2020 and beyond.

Metals

Gold (Long). Buy. High. Gold is one of the best performing assets YTD in USD, and rebounded very quickly with after an initial March 2020 sell offs. The rebound was a direct response to the FED stimulus packages for the general economy. Gold is trading at 7 year highs in USD (near $1700) but importantly gold has made already made new all time highs in just about every other major currency such as Euro, UK Pounds, Canadian Dollars (etc). Select currency and 20 years on this Bullion Vault to chart historical gold price in each currency. Bought deep in the money calls on physical gold ETF (GLD) with an approximately 90 delta for Jan 2022. Aim is maintain a gold position, to ultimately replace with some actual physical gold, when the current spot to physical price premium subside. Aside from just the physical metal, gold miners should benefit from lower oil prices and therefore have reduced input costs, that should increase earnings per share in 2020 and beyond. Gold miners are up about 30% since purchase of Jan 2021 deep in the money calls in both major (GDX) and juniors (GDXJ). These are potentially multi year longs.

Silver (Long). Buy. High. The gold/silver ratio is at about 113 which means that silver is historically very undervalued compared to gold. Interestingly the silver price is approximately tracked the Dow (DIA) year to date, being down about 15% – so it does have more of an industrial market supply and demand component. Gold tends to function as a true safe haven, but silver can influenced by industrial supply and demand from economic conditions. Silver can definitely sell off in a general market downturn, where as gold is holding its value better. However if there is to be a significant gold bull market, silver will tag along for the ride, but may take more time to turn around. Trade was bought physical silver and silver metal (SLV). Bought deep in the money calls with an approximately 85 delta for Jan 2021.

Uranium mining stocks (Long). Potental new uranium bull market for 2020s. Uranium producers and explorer stocks have been one of best performing sector and are up YTD – beating general indexes. Uranium equity could definitely get caught in a wide market downtown, but has tracked higher physical uranium prices that have increased from low $20 to $32 in last month. Ideally this is a very specific sector mining play that should be a play on the physical price of uranium, and should not be correlated to the general market. We play this with a small position in a very small ($4 million market cap!) and brand new ETF of uranium producers URNM. This could be a multi year trade, but the risk reward setup seems good.

Energy

Oil drillers (Long, short vol). Buy. High. Added new full size positions in OIH. Made bullish call last month on OIH was trading at around $4. In OIH sold cash secured $3 puts in July 2020 and Sept 2020, because the implied volatiliy was insane (over 100%), and combined with half a position in long OIH stock. This position bounced nicely, so bought back the short puts for good profit, then hedged the remaining stock with a wide put bufferfly in July 2020. Sold 40% out of the money call in July 2020 to help finance the put butterfly a bit. This is neutral to long ish bias on OIH until July, but it has run up a lot in April so it is sells off in May (seems likely to take a break) then the put buttefly will make some good money, even if the OIH stock loses money. Note that OIH has had a 20:1 reverse split this month, so the $ option strikes mentioned above will need to be multipled by 20 to compare to a current OIH chart.

Oil explorers (Long, short vol). Buy. High. Added new full size position last month on XOP (same timing as OIH trade). Bought a deep in the money for Jan 2021, then overwrite with call spread for May 2020. The call spread recently had both legs in the money and was only 2 weeks to go to expiration. Therefore overwritten call spread was rolled to Jun 2020 for a minor debt. The aim is to maintain the deep in the money Jan 2021 call, and keep overwriting for the rest of the year. If XOP goes up a lot we will capture majority of move. If stays same we can get some income from the high volatility in the call spreads (if they expire worthless). If goes down we will lose, but much less than stock. One advantage is if XOP price goes down fast the implied volality will go up, and so the deep in the money call will stay bid. Note that XOP has had a 4:1 reverse split this month, so the $ option strikes mentioned above will need to be multipled by 4 to compare to a current XOP chart.

Natural Gas (Slightly long, short vol). Hold. Medium. The natural gas etf (UNG) is hard to hold long stock for several months, due to the current contango in natural gas futures. Contango is when near month natural gas futures trade lower than far month future prices. (UNG) maintains its natural gas price exposure by constantly rolling contracts – specifically buying more expensive far month futures contracts, by selling the expiring (and cheaper) near month contract. This enforced rolling built into the product, creates a long term drag on prices while natural gas is in contango (look at any multi year chart of UNG). This is a less extreme version of the same problem with USO contango this week – when the oil price went negative (!). Since owning (UNG) stock is not a good idea, the setup is usually buy a long term calendar call spread, and also selling near dated call spreads on (UNG). This takes advantage of high implied volatility with limited risk, but can still benefit if prices are higher or neutral. This does sacrifice large profits if (UNG) spikes higher quickly and cannot roll fast enough into the price increase.

Natural Gas Producers (Long). Buy. Medium. US natural gas equities have been beaten up in 2020. Clearly there are is a huge over supply of natural gas and a massive worldwide demand shock for energy. (FCG) tracks an equal-weighted index of US companies that derive a substantial portion of their revenue from the exploration & production of natural gas. Approximately 15% of its portfolio is in MLPs and the remaining 85% to equities. Interestingly the (FCG) attempts to recovers some of its 0.6% management fee by securities lending, and it does have a dividend yield but that will likely disappear to much smaller amount in 2020. However to place this in some historical context, many US natural gas equities are trading at the lowest price for 20 years. For example, buying natural gas producers index (FCG) for $5.50, when its all time high is about $155 in July 2008. The US natural gas producers sector at these prices is low enough to be a binary trade. Either the majority of the US energy complex is going bankrupt and this is a slow grind lower for many years (“lose”). Alternatively some energy demand returns, the survivors consolidate and a restructured sector operates at higher price levels at some point in the next few years (“win”).

Equity

Cloud Computing (Long). Buy. Medium. More e-business activity (e.g. Shopify) for starting new businesses and tools for people working for home. This is long equity ETF but focusing on cloud technology (CLOU). Actively trying to ignore struggling parts of economy (e.g. airlines, manufacturing, automative, consumer financing etc). Positions in CLOU and other tech ETFs will be actively hedged with QQQ OTM call spreads.

Mortgage REITs (Long). Buy. Medium. MReits were trading at significant discounts to book value in April 2020 This was definitely a speculative buy with high yields around 11%, especially because dividends could be heavily reduced in next year. However if MReits can simply maintain their value, and allowed to DRIP for a number of years (even at these levels), then they can add some welcome yield and maybe some capital appreciation. MReit ETF (MORT) is a high yield trade great for a portfolio position in an IRA, because it can be allowed to DRIP long term. This is relatively risky play, and only medium conviction. There is no simple way to hedge this using options, so will only take a half position size to manage the risk.

Solar ETF (Neutral). Sold. Medium. Fortunate enough to sell Solar ETF (TAN) around $34 after the bounce back up to $37 in early March 2020 (not the top, but about 20% off the high the way down). This was a risk off trade, which preserved some capital initiate some of the other new ideas in this portfolio.

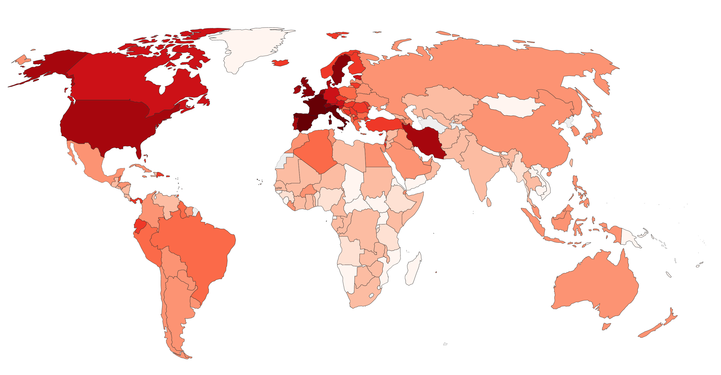

Emerging Market Equity (Short). Buy. High. Emerging market companies that have debt denominated could have a hard time paying it back, with economic shutdown and currencies depreciating against USD. Emerging market equity like Brazil (EWZ), Mexico (EWW) and India (INDA) have not bounced back as fast as the main US equity markets. For example Brazil has traded in an approximate range of $21 to $26 over last month, down from a Feb 2020 peak of (this is a “L” market chart, not the “V” market chart). Two trades here were 1) out of the money Long Put EWZ butterfly in May 2020, fully financed with short call spread on India market (INDA). This was neutral to bearish. 2) in the money Long Put EWZ butterfly in May 2020 for a debit, and no short call spread. This was more bearish. Brazil equity market has proven to be weaken than India in April 2020 so that seems like a good trade choice approaching May 15th 2020 expiration. INDA trade should expire worthless. Brazil trade already in the money and likely to still be there closer to expiration.

High Yield Corporate Debt (Short). Buy. High, now Medium. Corporate credit quality is being impacted by an unknown amount due to corona virus shutdowns, so that uncertainty would cause high yield corporate bond ETFs to trade significantly lower in the next couple of months. Entered an in the money (ITM) put butterfly as a limited risk reward way to short high yield bond ETF (HYG) on 17th March. HYG was at about $77 then went down 10% in a hurry to around $70. The risk was managed with the limited risk trade structure of an ITM put butterfly, but still got “taken to the cleaners” by the announcement that the FED would be buying junk corporate bonds. This policy announcement caused a huge HYG rally in April from about $70 to $80. Unless there are signs a sharp move down in high yield this week, it will be closed this week approximately 10 days before 15th May expiration – losing about two thirds of original trade capital this week. This is to preserve one third of the remaining principal from a losing trade, as a put butterfly that is now out of the money will decay much faster into expiration. A classic example of a good initially profitable good trade entered for the right reasons, but taken out by unprecedented policy decision. Trade was a loser, but have successfully managed the short risk by not having an unlimited short risk trade on.

Crypto

Cryptocurrency (Long). Hold. High. Bitcoin (BTC) and other alt coins (e.g. XMR). Holding not adding any more.

Liquidity and Hedging

Peer to peer lending – Lending Club (Neutral). Sell/Hold. High. Already dialed back risk here several years ago due to lending club management issues. However this month turned off auto re-investment of cash into new notes. Definitely do not want any more exposure to consumer credit for next year or so. Peer to peer is a small position, but turning off re-investment seems prudent until can figure out what is going with the general consumer lending (does not look good in short or medium term).

Cash (Long). High. Long USD for investment opportunities and saving up to get properties with low LTV. On existing international property businesses we are looking to open small home equity line of credits on properties with low LTVs in local currency (assuming local bank allows it). A small amount of debt exposure in local currency is effectively a long USD position (since we are based in USD). If the local currency for a country where we own property declines significantly we may consider paying down mortgage principal from USD cash.

Hedges (short, combined with underlying positions). Buy. High. Index call spreads overwriting out about 2 months. similar idea to covered covered calls, but with limited risk reward so that if the market does go massively higher are not losing so much (and can probably roll out of it in following months). Selectively combining put butterflies with hedges.

COVID-19 coronavirus portfolio – Summary

This tactical portfolio was created relatively quickly. The main themes were long metals and energy, with some technology and potentially some real estate later in the year. There are also some relatively aggressive hedging and other complimentary short positions. This is a long/short portfolio, that would be much more heavily hedged if world goes “risk off” again. Having good entry points in April 2020 should definitely help holding positions for longer term. The other main theme is keeping very liquid and not over allocating to make sure money is available for opportunities. In summary, only trade if you want to, not because you have to.