Gold Futures – Trade Exit on 15th Aug 2016. We can use Futures Options to go through Bull Call Spread example. We originally entered a gold Bull Call Spread with a slight bullish bias in Gold, but mostly just to get some trades on. The Bull Call Spread is a limited risk reward trade with typically a one to one risk reward. Typically we would pick the options on futures that expire 45 to 60 days out. This gives plenty of time for the trade to move in the expected direction. This means that you don’t have to monitor the trade too closely throughout its lifetime, with is important with a 30 day rule.

However even if the trade is totally wrong, then can likely salvage a bit of value to either exit, or re-establish in the next monthly cycle. e.g. if the trade was placed for $500, it might only be worth $250. At that point could sell the whole spread, then do the same trade at the same strikes for the following month – this simply allows time in the trade if you still like the trade idea.

Gold Futures – Trade Exit

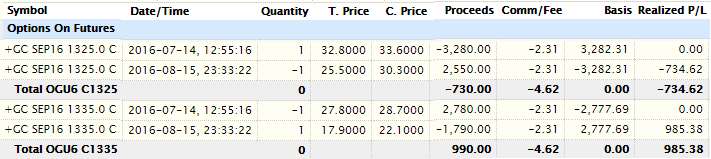

The specific trade was entered on 14th July with $1325 / $1335 bull call spread when /GC was around $1330 – essentially attempting to exactly middle the spread around the current price, but still defining the amount of risk to take. The trade cost $5, simply $500 per /GC contract. At expiration it could be exited for a max amount of $10 ($500 gain) or expire worthless for $0 ($500 loss).

This shows trade entry and exit prices:

On 15th August /GC was about $1345 which is about $10 (0.75%) over our max profit strike, which is not a lot distance for the several days remaining in the trade. The trade had a profit of about $200 out of a maximum of $500, but clearly was only slightly out of money so that could be erased with a swift down move. However on investigating the delta of $1335 call gave about 63 delta which meant that it had about a 63% chance of making money by expiration. However we also know the probability of a touch at a higher strike is much higher than the probability of finishing at a particular strike at expiration. To define that another way – although this was currently looking like a marginal trade, there was still a high probability of exiting with a 50% of max profit ($250 profit target out of a maximum $500) between now and expiration.

There we set the limit profit order to trigger at $250 profit or $7.6 limit. Technically this would be $7.5 limit, but we set an extra $0.1 on the limit price (or $10 value) higher over our profit target to allow for commissions. The commissions on this trade are 2.31 for each option leg for entry and exit, which is $9.24, which is over time this adds up, so moving the limit by $0.1 covers those commissions nicely.

We then went to sleep, and luckily in the morning the limit had been filled due to a nice rally.

The following chart shows the full trade life cycle marked up with our comments:

In summary there was more profit available in this trade that ultimately we didn’t take, however we did make a solid 50% profit on capital risked. Also the trade reversed recently in the last week, meaning that if we had held on into expiration we would know be looking at -$200 loser (using today’s prices). The difference between taking the $250 or waiting for the -$200 loser is $450, so that is a significant swing for the trade size. Therefore taking the profit on the profit target was the right decision, and consistently taking profits on the winners helps balance out any future losing trades. We are getting better about not being disappointed with not making the “maximum” each time, and now we try simply moving on to the next trade.