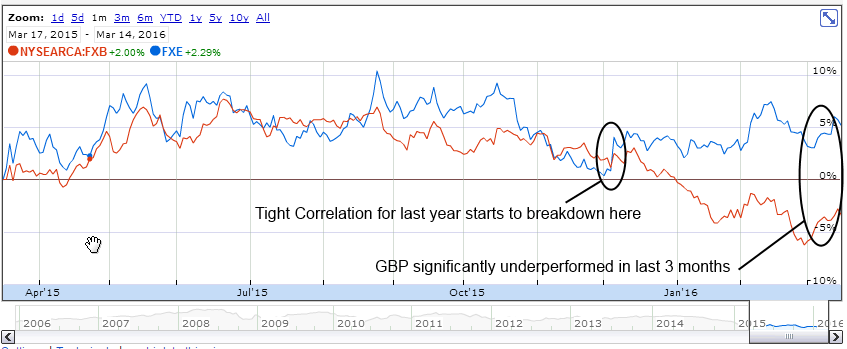

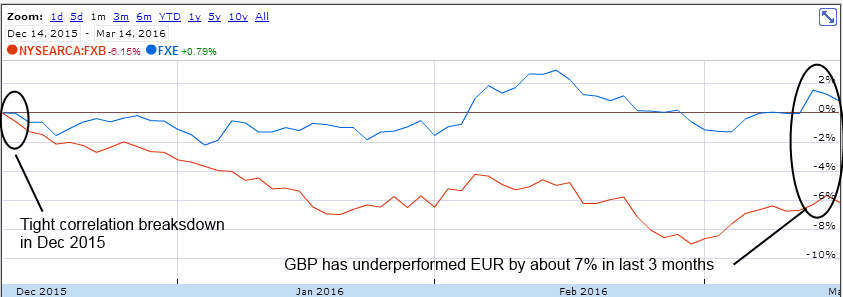

Last month Brexit Short Pound Long Euro Trade update we started a medium term trade betting that the pound will trade lower into June Brexit on fear of an exit poll. The trade was to short Great British Pounds (GBP) using 3 E-micro futures /M6B in Jun 2016 (symbol /M6BM6), and long Euro (EUR) using 2 E-micro futures /M6E in Jun 2016 (symbol /M6EM6). Each side had a notional value of approximately $26k USD. The 3:2 ratio is simply chosen so that the notional amounts are identical, because of the different contract size for each currency. Trade entry was 14th March 2016. We originally attempted to hold it as a position trade into the brexit referendum date in June 2016, but if our risk management rules take us out we will exit.

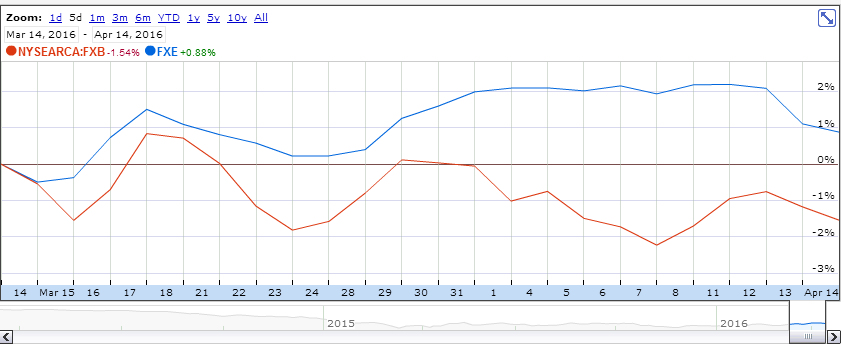

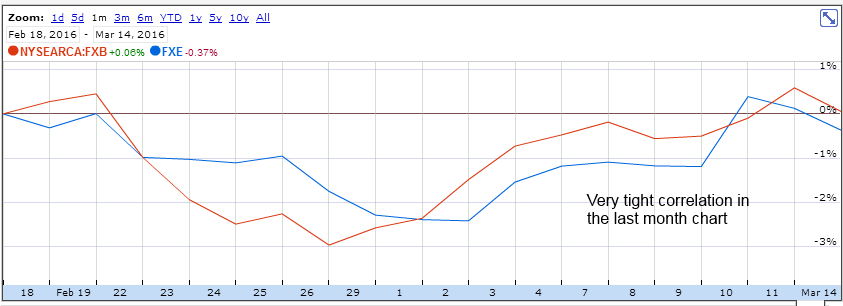

The Great British Pounds (GBP) future was the original short, and we sold Euro (EUR) against it to offset the risk somewhat. Because the Euro moves closely with the Pound over last year, this is a fairly closely correlated pairs trade. Pound is relatively flat for last month, and the euro had rallied a bit.

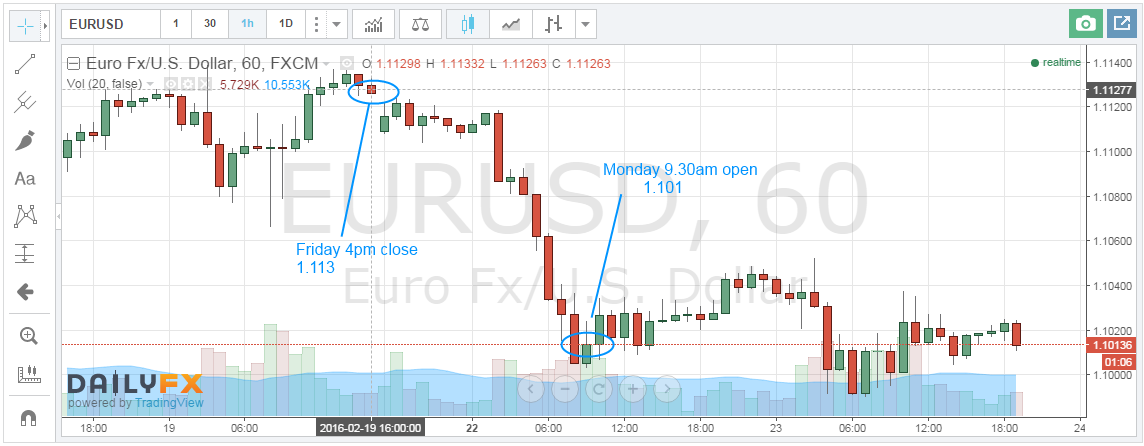

Recall from last month, we also had also completely hedged with opposite fx positions into the March 17th BOE meeting.

Profit Loss update at end week April 15th

Looking at the overall position on April 15th 2016 approximately 1 month later we have:

$250 profit on short 3 E-micro futures /M6B

$350 profit on long 2 E-micro futures /M6E

-$100 on long pound fx hedge

-$150 on short euro fx hedge

Over this month the Pound has been down about 1% and Euro up about 1.5% (so not a huge amount of movement). However this price movement has given some options to make position adjustments.

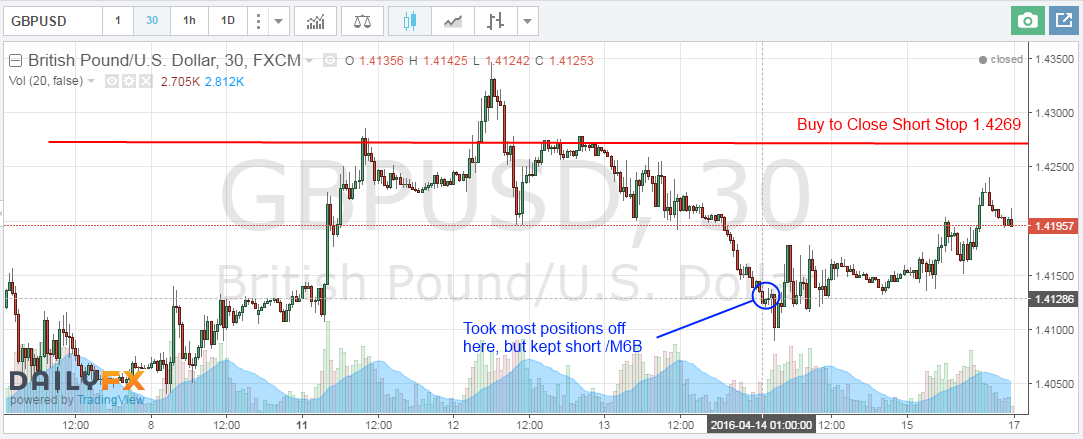

We exited all positions, except the Pound future, for a total profit of $100. Then immediately added a stop to buy back the short pound at 1.4269 (entry was 1.4282). This stop was chosen only to allow for about 0.0013 slippage on the micro future and still guarantee a small profit of about $20 on the short future position. This would give us a total minimum profit of about $120 ($100 + $20) on the entire position, and still gives approximately a 1% wiggle room to the stop. However it is still possible (and potentially likely) to get stopped out, but crucially we can still maintain the short pound position with no risk from the overall trade. If we get stopped out, will likely be able to establish at better levels. If GBPUSD continues to go down, then will have established a decent sized position for no risk – if that happens, then likely would exit before the Brexit decision in next few weeks.

Final (enforced) Exit on Mon Apr 18th

Update: as of Monday, got stopped out this morning at 1.4270 so no longer have any position. Note the 0.0001 slippage from the actual 1.4269 stop. Cannot rely on stops to exit exactly at specified price, so always allow for some slippage between the stop and your required exit price. The slippage is typically dependent on product liquidity and when the stop executes. These FX Micro futures on /M6B are typically liquid with 0.0001 spreads during the day, but appear to move to 0.0002 in overnight US trading. You may get better executions during US hours. For example our execution was with only 0.001 slippage at 10.56am.

Total P&L was $120 – we had locked in a gain originally of $350, but that last adjustment from Friday cost us about $230 in giving back profits. However even though it got stopped out today, we did manage the risk well and ultimately turned the position into a “zero risk” trade.

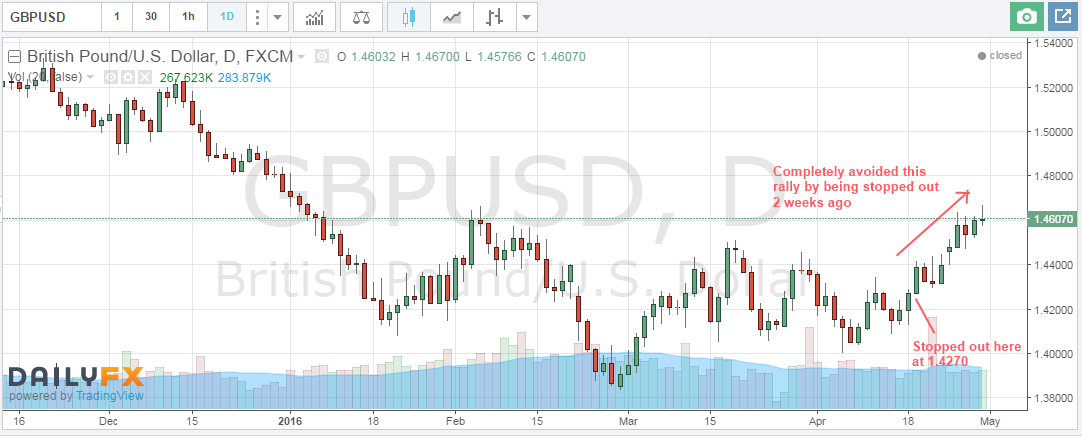

Trade exit final review on Fri Apr 29th

Reviewing this trade again after the exit 2 weeks ago, shows that the in short term the trade theory was invalidated. The following chart shows how the trade would have moved significantly against it, if we had stayed in it.

However we did make a small profit – we might look a retrying this trade soon as these high levels. The importance of our risk management is that we are not emotional scarred from being wrong, so we can evaluate any new trade on its merits, not trying to get back to break even.