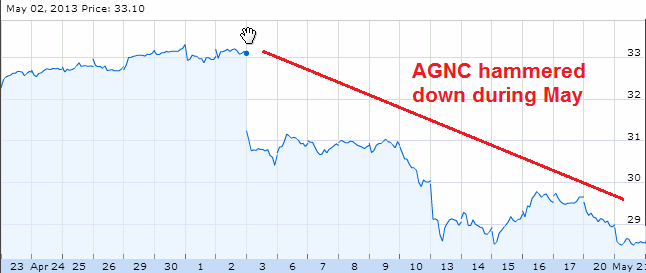

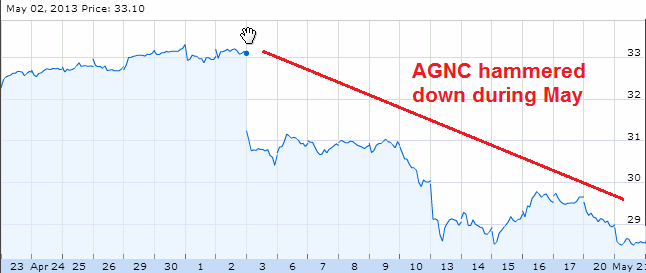

Agnc moved down, and relatively quickly from May 2nd $33.10 to May 21st $29.55.

The June strike 30 put option has protected us relatively well. However getting closer into June expiration there is battle between negative time decay in the near term Jun (losing money if agnc doesn’t move down) and the positive downtrend in the agnc stock price (making the overall position money). The position is now slightly short agnc with an approximate delta of -0.10.

If we are to hold this position we need an increasing swift agnc decline into June expiration. We took the position off today on May 21st because we got a nice 1.5% downdraft. We still exited with approximately a $500 loss on all 2 option legs position.

Any bounce up in AGNC of more than $1.5 (to $30) could cause losses over $500, so the risk/reward to holding the short for the 30 days to June expiration is skewed to it moving down increasing quickly. AGNC standing still will lose the position money. Any time you *need* the market to move in a particular direction in a relatively short timeframe or you will lose money every day, it is usually not a good risk/reward trade.

There is also significant event risk for mortgage REITs tomorrow May 22nd with Ben Bernanke’s speech at 10am. This will likely be market moving for AGNC based on the FED’s bond buying program.

Overall the position lost about $100, which was unfortunate. However our original investment thesis was that AGNC would remain stable over the summer was proven incorrect. Agnc declined from trade entry $33.20 on March 16th, to $28.55 on May 21st (-14% decline). By way of a simple comparison, only 100 shares of agnc would have lost -$465 + $125 dividend = -$340 (and we were trading 8 contracts, controlling equivalent of 800 shares).

We can roll the entire structure down to lower agnc strikes and try again to make our $100 back. This wasn’t a positive result, but at least we get to try again without significant losses.

Remember we have to hold each option leg for 30 days, which is why we sometimes adjust (add legs) when selling would be easier.