Natural Gas (NG) price has been consistently declining due to significant over supply for the last few years. In general there are consistent seasonal drawdowns of NG supply throughout a trading year, usually due to consumer energy demand for heating or cooling. Typically large drawdowns of NG supply in winter for home heating from November to March. However there can also be periodic supply drawdowns during summer heatwaves with energy demand for home cooling.

Natural gas is historically cheap on an absolute basis, but needs a catalyst to justify a longer term higher prices. The historically cheap price is encouraging countries to reevaluate its use. NG is not considered as “clean” as alternative energy being found near oil deposits. However practically energy will have to come from somewhere. As China’s climate change commitments force transition into “cleaner” energy solutions, they need to plug the gap between oil/coal and transition to alternatives like wind/solar. However NG could becomes up to 15% of China’s energy market by 2030 then that potentially increase demand and maintain pricing this decade. Taking the other side of the argument though, the increase in Chinese NG production into 2030 could dampen the NG price further by over supplying the market.

There could be a good decade long position trade here, but history shows that NG has been following the pattern of lower lows for many years. The following chart shows the Nymex natural gas futures price for Aug 2021 settlement. Starting at $8.88 in Nov 2008, down to a low of $2.21 in Feb 2020, followed by the current price with a bounce back to around $4 in July 2021.

As the commodity price chart shows – it is hard to justify as a long “buy and hold” trade due to this secular bear market. However it’s rapid spikes make it an excellent trading vehicle, with the right timing. Fortunately 2021 appears to have produced a hot summer that has created a natural gas trading catalyst – so there is no need to wait until 2030 to find out how the trade performed…

Long Hot Summer

The main short to medium term factor driving NG prices is energy demand due to higher than normal US temperatures. Natural gas as a fuel has a different trading dynamic to natural gas producers stock (e.g. such as the FCG ETF). Natural gas price tends to trade off near term supply and demand (up to 6 months out), where as natural gas producer stocks tend to trade off medium to long term expectations for natural gas prices (often 12 months or more out in time). Additionally some producers have locked in contracts (“hedged” pricing) – so short term near month price changes don’t impact longer term prices that could be locked in or haven’t moved that much. The /NG futures curve as of July 2021 is an good example of this phenomena:

Natural gas is not a “forever” trade. However the short term market supply issues mean that pricing can potentially spike in the next few months. One of the main trading vehicles for natural gas is the UNG ETF that attempts to track the commodity price. The implied volatility on UNG options is certainly showing that a large move is possible – with implied volatility moving up from about 30% to over 50% in the last month.

However the July 2021 future curve (from Nymex natural gas futures) is implying a return to “normal” pricing in 2022. From a medium term trading perspective, any significant spikes should be used to reduce risk in the next few months.

The July 2021 futures curve is not always the shape of the commodity futures curve. Typically the main ETFs (such as UNG) that track NG have a structural decay problem, due to rolling futures every month. The ETFs do not hold natural gas as a raw commodity because of storage costs, so they maintain exposure using futures. Usually the ETFs futures holdings are near month to get as close as possible to the commodity spot price. However maintaining this position requires the consistent need to “roll” every month, usually when the near month future gets close to expiration. Rolling means selling the expiring near month and buying the next months future contract. This generates transaction costs every month, but more importantly roll costs can eat away at the capital in the ETF. The next section explains this roll cost in detail.

ETF Roll Cost

More importantly though for the Natural Gas ETF is whether commodity pricing is in contango. Contango is where the price of commodity contracts further out in time are more expensive. Futures prices out in time by many months are sometimes referred as “out on the curve”. The following graph that show an example commodity pricing curve in contango. This example is not for natural gas, so the exact numbers and dates are not that important – it is just a sample contango futures curve to show the idea.

Contango pricing plays an important part in the long term Natural Gas ETF (UNG) price. UNG typically holds near month Natural Gas futures to approximate the natural gas price. The near month futures contract is normally natural gas for delivery in the next 30 days or less. As the near month contract gets closer to expiration, the fund must roll into the next month’s contract to maintain exposure. If this is not done then the near month contract would expire, and the ETF would acquire several hundred million dollars worth of physical natural gas for delivery! Depending on the funds specific mandate, the “roll” may be done over several days and likely several days prior to expiration. The “roll” is a monthly process to maintain the price exposure.

Using the futures symbol for Natural Gas \NG the following example shows a roll between two separate months. The exact date and pricing shown is not as important as demonstrating the concept. For example if \NG August is $3.50 and \NG Sept is $3.55, then the fund has to sell $3.50 and buy $3.55. This generates a “roll cost” of $0.05 per month (difference between $3.55 and $3.50) just maintain the position. Additionally due to the higher price of the new purchased futures contract, the total number of futures contracts held by the ETF gets reduced. This price difference maybe relatively small (e.g. less than 1.5% of the fund) however compounded over time every month it adds up. This roll loss explains UNG terrible long term performance – as well the actual physical natural gas price trending down.

This chart dramatically shows why UNG is not a “buy and hold” investment, down more than 99% since inception:

It is important to note that the opposite condition to contango can assist the Net Asset Value of the ETF. The reverse of contango is called “backwardation” – when futures prices out several months are less expensive than near month futures. Backwardation helps the ETF maintain value and only contango has the rolling issue above.

Avoid Buy and Hold

Commodity ETFs like UNG or USO that are often in contango and use near month futures to track the commodity price, should not be held for long term trades. They are tradable for daily or monthly trends, but not usually years.

The other important thing to note is that commodity ETFs using futures don’t always rebound after big crashes. Often contango rolling impact is greatly increased after a crash due to market dislocations in the front month. One extreme example has to be this year in April 2021 when the May Oil price briefly traded at negative $40, but month further out were positive (massive contango). They also do not track the underlying commodity price accurately over a number of years.

This can be shown very clearly when comparing two ETFs that track the oil price using futures – USO and USL. Although both ETFs use futures, USO typically tracks only the daily changes in the near month oil future. USL tries to track the daily changes in the near month to 11 months out (from the near month). That is the average price for all futures contracts in the next year, not just the next month. Since the oil price is often in contango, USL will track it much closer than USO. The following chart shows the huge difference in performance, that can be clearly seen around April 2020 during the “negative oil” futures incident (USO is blue and USL is yellow):

Understanding the futures curve shape and the average duration of the futures held inside an ETF is important before placing a trade.

Trading Position

Options that have over 1 year to expiration are called Long-term equity anticipation securities. They are often abbreviated to “LEAP call” (for calls), “LEAP put” (for puts) or “LEAPS”(for any option either calls or puts). UNG OTM LEAP calls cost a relatively small amount, but can control large position sizes. Depending on how far OTM there is a higher probability (say 60% to 75%) that they lost value slowly over time. However they can only lose the entire premium paid for the position. But if natural gas spikes higher they can quickly go ITM and trade with much higher deltas. They therefore have a great asymmetric risk to reward profile, especially if started during low volatility. They are likely to fail, but if they win they can win big.

On trade entry by definition OTM leap calls will ultimately expire worthless more than half the time (if they were held all the way to expiration. This is because they have a delta of less than 50% on trade entry. When a LEAP call is losing money any residual value for the decaying option can reclaimed by selling at 50%. For example, if originally bought Jun 2022 $12 calls for $1.5 then could sell after it has decayed to $0.75 to maintain some value. Another approach is simply to position size appropriately for the portfolio and let it expire worthless (having already accepted the full risk as part of the portfolio). Alternatively can roll out in time to further six months if want to maintain the position. Our approach is normally to exit position and maintain some value if not working or roll out in time. Don’t normally let the LEAP go all the way to expiration.

To manage upside we would typically take some profit off the table at 100%, if reached in short order. For example, consider buying a LEAP more than 1 year away for $1, then after a price rally selling half for $2 two months later. This means a zero risk trade for remaining 10 months of the option lifetime. The position is now half sized, so will not make as much potential profit. However half sized position can now be allowed to run for many months to see how it does. Since this example position contains no risk it could be allowed to run almost to expiration to see how it does. Unless the calls are very deep ITM (low time value) should consider rolling or selling with 60 to 30 days to expiration to avoid option decay.

Implied Volatility

Paying attention to implied volatility (IV) on trade entry for LEAP calls is important to maintain trade value. Since LEAP calls are sensitive to increases in volatility, rising volatility can provide a trade profit even if the underlying does not move that much. The important IV measure is not just the absolute percentage (%) as “high” (e.g. 50%) or “low” (e.g. 10%). The measure used for trade entry is the percentage (%) relative to the recent IV historical trading range (usually 1 year). Ideally LEAP calls are bought when IV is towards the low end of its annual trading range. For example, assume an IV trading range for the previous of year of 9% to 20%. Buying when UNG IV is 10% would be buying at the bottom of the volatility range. Once the trade is on, looking at option vega will show how much the option would increase with a 1% move higher in volatility (all other variables being equal). It is quite possible to see a significant % profit in a LEAP call if volatility rises quickly. Importantly LEAPs trade on expectations for future volatility at option expiration not on for expectations for the next few days or months. Although short term and long term volatility are usually correlated they may not necessarily move with the same magnitude. A short term spike in IV may not move IV in longer dated LEAPs. For example, a natural gas supply crunch that will likely be resolved next month, may not move option pricing in 12 months because the market expects it to be resolved by then.

LEAP calls are not “buy and hold” trades and so do require monitoring and risk management. Holding the LEAP call only can be a valid strategy. However over the long term selling calls mechanically or dynamically can improve returns and risk management. Selling calls does limit the theoretical unlimited upside, but on average it improves and smooths out returns. Selling calls does not have to be done against the entire LEAP call position, so with some strategies the theoretical unlimited upside can be maintained.

Selling Calls Mechanically

Another form of risk management is selling calls against the long LEAP call. This can be done ATM to try and exit position, but still get some premiums for next month. Alternatively this can be a scaling out exit strategy, to sell OTM calls next month, 2 months and 3 months out. For example if UNG is at $12, sell the July calls at $13, Aug at $14 and Sept at $15. This should give similar option premiums for each call sold, but gives more time for trade to rise and different time frames to sell calls. There is no role on the amount of contracts to sell, and it doesn’t have to match the long LEAP calls contract. For example if already own 100 LEAP calls, could sell 40 calls in July, 30 calls in Aug and 30 calls in Sept.

Alternatively if would like to exit half position can sell 50 next month ATM, leave the rest of the 50 contracts open. This gives the richest ATM premium that gets kept if position sells off. However if half the position gets called away in the next month cycle, then this still maintains half the position for further unlimited upside (no sold calls to cap the upside).

Repeating this monthly call selling strategies several times a year can help pay for the entire LEAP call. For example selling 10 calls ATM for $0.30 in six separate trades over 1 year would pay for buying a 20 LEAP calls at $0.90. This is a somewhat idealized example, because it assumes that the sold calls expire worthless each time. More realistic is to assume that half of the sold call premium is captured, so calls sold through out the year for $0.30 can on average to bought back for $0.15. This scenario is more realistic because it covers many call selling trading outcomes each month. For example selling 10 calls ATM for $0.30 in 12 separate trades could have multiple exit scenarios – some calls could expire worthless (full $0.30 gain) or need rolling into next month (e.g. buy back for $0.70 with $0.40 loss, then resell next month at $0.30). Taking loses on the sold calls still allows the position to make money, because the long LEAP call also increases in the rising market. However if the market rises too fast then sold calls could be hard to roll, so would be better just to exit the entire position.

Selling Calls Dynamically

Another more opportunistic strategy is to wait until IV increases during the year. This becomes more likely if the position was entered in relatively low volatility. When IV spikes up start selling “junk” options that are say 25% OTM. Depending on the level of the volatility spike these can be sold for between $0.10 and $0.25. Selling junk options for less than $0.10 is not recommended because commissions are a greater % of the trade. Also in a volatile market options that are way OTM but closer to zero (in the range $0.01 to $0.10) don’t decay that fast until very close to expiration – because there is always the underlying “threat” of a price spike.

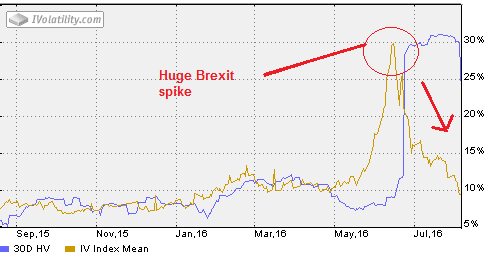

Occasionally the commodity market presents some incredible premium on OTM options. For example on SLV in March 2021 during the Reddit meme stock volatility spike the IV doubled in a week from around 35% to briefly over 70%. During that week sold several SLV call options way over $0.10 that would normally have near zero value. Their volatility was implying a more than 100% move in silver by expiration in less than 60 days. Of course the options ultimately expired worthless, but also the premium got crushed within a couple of days after the high volatility mean reverted (see chart).

High IV in call options tends to revert back to a the mean value, which means that on average it doesn’t typically stay elevated for long periods of time – so was a quick return on investment. This mean reversion is why on average call selling works in higher volatility. Importantly having a long LEAP call covers when the underlying moves outside of the average price range – that is when the sold calls go way in the money at expiration. In the above SLV example, the call selling was always covered (not “naked”) because it was done against a SLV LEAP call that was already owned earlier in the year (and established in lower volatility). Admittedly this is one of the most extreme example from a commodity ETF in the last few years. However consistently selling the “junk” options to compliment a fully covered LEAP call position, can make regular income and still keep the long commodity trade idea alive. There is always the possibility of being “called away” on a huge market rally, but that would be a happy occurrence because the LEAP call would have greatly benefited.

Selling Calls for Hedging

One word of warning on dynamic call selling is don’t sell calls that are at or beneath the LEAP call strike. When beginning a trading position that will sell calls, it is better to sell way futher OTM or not bother selling any calls initially. Sell calls over time is to reduce cost basis in trade – in this case reduce the amount paid for the LEAP call. If that uncertain on amount at risk when starting a new position, then simply trade a smaller position size – don’t over hedge to start with.

When trying to rescue a position where the LEAP call has lost money, do not sell strikes in the near month below the LEAP call strike. This is sometimes called an “inversion” position. This position can potentially lose money if the commodity price increases, which the opposite of the original trade idea. This is because if the near term short option goes significantly ITM it will start acting like short stock – with a delta that trends towards negative one hundred (-100). The negative delta on the short call will be greater than the positive delta on the LEAP call (likely in the range of 50 to 70 delta). Therefore the entire position becomes net short. For example, 70 delta (from LEAP call) minus 90 delta (from deep ITM short call) is minus 30 delta (short position). These deltas are realistic examples for what would happen if the commodity rallied 20% with this “inversion” position (short strike call lower than long strike call).

Short calls are great to generate income or exit a winning trade. however when selling calls only to reduce long deltas (i.e. reduce risk) it is probably better just to sell (to close) some long LEAP call contracts. Selling calls should always be a compliment to main LEAP call position, not exclusively for reducing risk by adding short positions to a long position (hedging). Sometimes the best risk management is just to sell underlying position, not try and over hedge with calls. If the concern is losing all the LEAP call premium, then the position size is probably too large for the portfolio.

Portfolio Strategy

Importantly however the slower time decay of this strategy allows holding the entire position through a downdraft, because there is time to recover the loss. No action is required with correct portfolio position sizing, because the risk is accepted on trade entry. The position size can be 1% to 2% of the portfolio for a “normal” trade, or up 5% for a high conviction position trade. In previous trading experience we found that these LEAP call strategy should not be sized over 5%. This is because the position is still all time value and as such is decaying every day (even though daily decay is small). Additionally the combination of strategies in a portfolio is very important. Should not have an entire portfolio of OTM LEAPs as strategy for all portfolio positions. For example, having 20 distinct LEAP calls each with a position size of 5% would be have unmanageable theta (time) decay. Essentially an entire portfolio of LEAPs would have be 100% time value with no intrinsic value. If running LEAP strategies on a few underlying ETFs, then other portfolio positions should be in short volatility strategies (e.g. credit spreads) to compensate for the daily theta decay.

Trading Update

Trade entry was to go long natural gas in 2021. In March 2021, bought the UNG Jan 2022 LEAP call (10 months out) for $0.94. A few weeks later UNG went down to around $9, and the LEAP was losing money. However there has been a nice rally into July 2021. When UNG pulled back from peak around $13 to about $12.60, exited half the position in case this was the “big one” for a pull back. Natural gas is hard to trade because spike up quickly with a nice profit, then be back to break even 2 weeks later. Obviously as soon as the position is halved, the market rallies – but that’s just trading. Some physiological experience trading cryptos is helpful, because the UNG short term trading peaks and troughs can have similar severity (even though the fundamental drivers are obviously massively different).

To get some extra juice in the trade, sold the $15 Aug 2021 calls for $0.20 against the entire position. The high premium for selling a 15% OTM call option was possible due to high IV. This trade is to tempt the market to try and hit a $15 target in only a few weeks, but also to hedge a pull back.

However as the market rallied again past $13 a couple of days later, realized that had made a mistake on being the start of a big sell off. Therefore was looking keep the long position for potentially higher than $15. This may seem like flipping ideas and being too wishy washy. However UNG looks more bullish then expected and resistance at $13 disappeared quickly. Basically would like to maintain a larger position size, but would like to have finger on the exit button. Also since had just made a nice profit selling half the underlying LEAP, we had the “house money” to do another long trade. So in order to maintain long deltas, bought the $15 Sept 2021 calls for $0.42. This made a calendar spread in the $15 Aug/Sept pair for total cost of $0.22. The calendar spread is in addition to the now half position sized underlying LEAP call Jan 2022 $11.

Trading Summary

This was an overview of how to use LEAP calls and short call overlays to trade commodity ETFs. The aim was to maintain a position, take risk off on the way up, and lighten up towards the end of the trend. Another trading update should be done when the current natural gas position is significantly changed or exited.