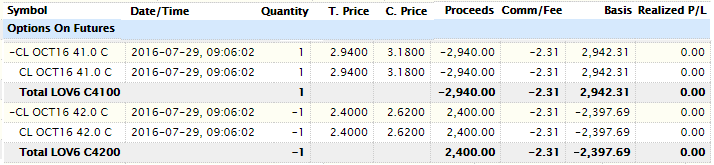

We can use Futures Options to enter a bullish oil trade using Crude Oil /CL Bull Call Spread – this gives a slightly bullish bias in oil. The Bull Call Spread is a limited risk reward trade with typically a one to one risk reward. The specific trade was entered on 29th July with $41 / $42 bull call spread when Crude Oil /CL was around $41.5 – essentially attempting to exactly middle the spread around the current price, but still defining the amount of risk to take. The trade cost $5.4, simply $540 per Crude Oil /CL contract. At expiration it could be exited for a max amount of $10 ($460 gain) or expire worthless for $0 ($540 loss). This was slightly worse than our typical 50/50 bet (about a 46/54 bet!) but it was close enough to get the trade executed, without having to wait too long for the market to position itself exactly in between the strikes.

Trade Entry

This shows trade entry prices:

Looking at our portfolio, we also have on a post Brexit short CAD call spread that was acting as a nice counter balance to this trade. The Canadian Dollar /6C and Crude Oil /CL prices are positively correlated, meaning most of the time if oil prices go up, then Canadian Dollar would also rally.

Trade analysis

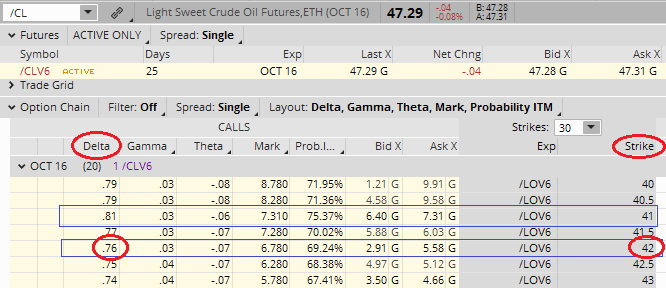

On 26th August /CL closed at $47.29 which is about $5.29 (12.6%!) over our max profit strike, which is very likely to realise the maximum profit of $460 if held all the way to expiration. The current open unrealised profit is $350. The blue rectangles on the Crude Oil /CL option chain below highlight the $41 and $42 strike options that make up the trade. The red circles highlight the strike and delta for the $42 call. This shows that the $42 call has about a 76 delta which meant that it had about a 76% chance of the spread being in the money by expiration (and making the maximum profit).

However the 30 day rule period will be up on Monday 29th August, therefore we set the limit profit order to trigger at $400 profit or $9.5 limit (which is 85% of max profit). We would like $400 out of the trade, so we have to set the limit $0.1 higher to allow for commissions. With no commissions $400 profit would be $9.4, but including commissions it is $9.5. Technically there is $60 extra to make in this trade by holding all the way to expiration, but that would be about $940 risk to make $60 over 20 days into expiration so probably worth just closing it. It could be left to expire for next 20 days, but according to the option market there is a still a 25% chance that oil crashes to our higher $42 strike by expiration – so it is safer to exit on Monday for most of the profit and not have to worry about it.

The following chart shows the full trade life cycle marked up with our comments:

Oil Futures – Trade Exit

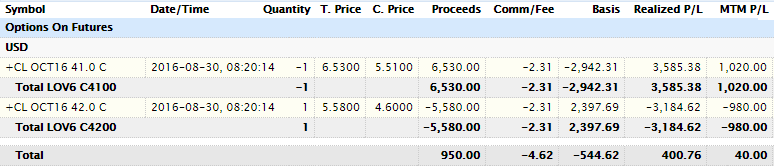

In the slight oil rally on 30th Aug the limit order was triggered and trade exited. This shows trade exit prices:

In summary we made almost the full profit available in this trade, and exited as soon as possible after the 30 day rule allowed, but still let the market trigger the limit order for us to get the target $400 – this was a solid 74% profit on capital risked (profit $400 / risk capital $540 = 0.74).