Monero XMR – Trading Update needs to be given this week, specifically because the market has recently moved massively upwards since the latest trading update in March 2016.

Please note that due to market volatility it is quite hard to capture consistent pricing for screenshots – so any prices given or calculations done using those price are only indicative (but they should still be approximately correct).

Monero XMR – Trading Update – Overview

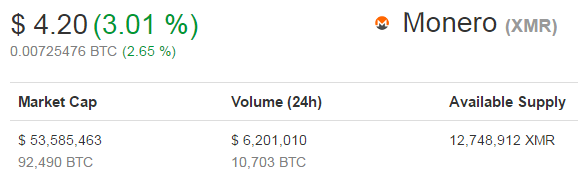

As of Aug 22nd 2016 there are currently available approximately 12.8 million Monero XMR. With a current Monero XMR price of $4.20 USD, that gives a marketcap of approximately $53.6 million (in USD). This size compares it with a small penny stock, so it still has significantly size to grow if it is even slightly adopted for any mainstream uses. The following screenshot from coinmarketcap.com gives a quick overview:

Since most people probably have not heard of it this is a quick overview – Monero is an alternative currency (sometimes referred to as “coins”) with the most well-known being Bitcoin. In the last 2 years there have been many such coins created for a diversity of purposes. These new “coins” are the brave new world for cryptographic currency (“cryptocurrency”, or even “crypto”), but are still in the early adoption phase. One of the main selling points of Monero is that it can mathematically provable as truly anonymous, unlike Bitcoin with can be traced via the Block Chain. It is one of the foremost alternative crypto currencies that has actually survived long enough to potentially become a replacement for the well known Bitcoin (BTC). For some more background you can review our original investment from last year.

Monero XMR price since inception

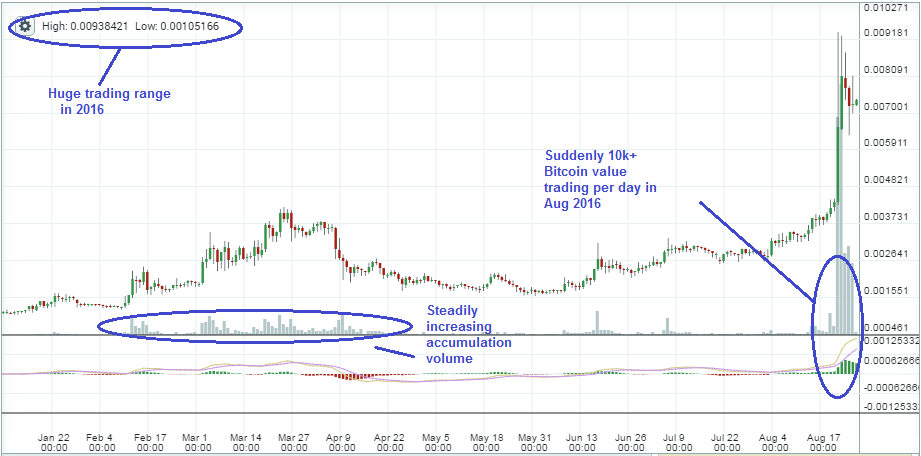

The following chart shows the price swings for Monero since inception, priced in Bitcoin BTC. This highlights the mini price bubbles on inception, in Mar 2015, Mar 2016 and most recently in Aug 2016. You can track the real time Monero XMR to Bitcoin BTC price here.

Monero XMR Trading Update – Year to date 2016

This price move appears to be a significant move on large volume, therefore worthy of a trading update. Monero XMR is going up because of fundamentally wider adaption in other market places, which means that it will get used as currency of choice by more people who want crypto currency. Specifically this move has been driven by news that leading dark net market will start supporting Monero. The assumption is it will win the war to be adopted as the primary crypto currency, potentially ultimately replacing bitcoin (but that is several years out). Don’t know if move is sustainable in short term, but it’s based somewhat on fundamentals, not just a speculative pump (with no reason) which sometimes happens with these coins.

The following chart zooms in to show the significant volume move year to date up to August 2016. From a low of 0.00105 BTC to a high of 0.00938 BTC, with a current trading price of about 0.00735 BTC on 22nd August 2016. In the last week Monero has traded approximately 65,000 BTC on poloniex. Assumming the average Bitcoin price of $576, that is approximately $37.4 million USD.

Valuing Monero in US dollars

Importantly all the Monero charts shown above are valued in Bitcoin BTC. The Monero Bitcoin XMR BTC exchange rate is more reliant on the value of bitcoin itself. So if you liquidate any Monero using the XMR BTC price you then obviously end up holding Bitcoin, which can obviously have it’s own price volatility (and is a competitor for Monero). For example if positive Bitcoin related news caused the Bitcoin price to rise faster, the XMR BTC will go down even though nothing may have fundamentally changed with Monero.

Therefore looking at the Monero XMR exchange to USD dollar can be a better independent value indicator because it doesn’t depend on value of bitcoin.

There is a USDT coin that literally stands for “US Dollar Tether” which is a coin representation of USD cash. As the following chart shows Monero XMR to USDT (USD dollar) price is at all time highs in USD, similar to Monero XMR Bitcoin BTC price. However Monero has always mostly trended upwards in USDT (US dollars), without the Bitcoin related swings.

Liquidating Monero XMR into USDT means you are attempting to replicate “cash”, but importantly without having to convert back to physical US dollars. That is if you hold USDT it attempts to represent the equivalent in USD cash in your local bank account, but actually as a coin so you can trade to buy other coin. This is useful because there are increasing regulations about adding usd to coin related investment, and if you are already in the coin eco system this is a good way to “go to cash” with out actually exiting into real US dollars.

Haven’t done enough research to understand USDT long term stability – and its definitely NOT FDIC insured like a bank account! However presumably it is safe enough for a few weeks while you plot your next investment move (or move it to physical USD). However be careful with USDT liquidity if moving from XMR on poloniex, the order book (scroll down search for “Sell orders” section) may only support a few hundred XMR at a time so don’t try and liquidate a huge position without small test orders first.

eBook including our disclosure

In the spirit of full disclosure, our current position is approximately 0.1% of all outstanding Monero so we are definitely “long”. However that has been held from more than a year. The aim is for a buy and hold investment though and we very rarely trade the core position (for example, have made no sales for more than a year). We could exit or scale back significantly if something materially affected the Monero marketplace, however we are more likely to add on weakness not sell. The cost basis of the investment is relatively low, so we are not actively trading day to day. Typically the price drifts along, but then takes off faster than you can react, as per this recent month’s rally – so our investment option is that the ability to time trades around the position is not as important to actually have a position. We have no plans to sell any Monero yet, but if the price went exponentially higher we would sell to cover our original cost basis. However if you are a true believer in cryptocurrency for a long term medium of exchange you’d never sell any this cheap anyway.

If you are interested in learning more we have written an eBook Better than Bitcoin – A Beginners Guide to investing in Monero.