We look at the expected returns for a simple trading system of a limited risk/reward option strategy, and figure out its expected return. Then we figure out how we can improve it given our 30 Day Rule constraints.

This material is based on some external research from TastyTrade, so don’t want to take credit for it – we are just adapting it for our 30 Day Rule. If you are interested on the research source behind this post, we would recommend looking their Mechanics of Risk Reward video. The rest of TastyTrade is worth looking at too, because they have tons of FREE options and futures education that you have to pay for everywhere else. Plus they are generally quite entertaining to listen to 🙂

What is the strategy?

The trade we will create a strategy from is the Iron Condor 2 or 3 point wide, sold with 45 days to expiration (DTE). This is limited risk risk/reward strategy, that is risk $2 to make $1. You can also adapt this approach for other trades as well, not just an Iron Condor.

For this discussion you don’t really need to understand exactly HOW the Iron Condor works – just that will be assuming that we place a trade that has the following expected outcome if you hold it all the way to expiration:

| Trade Scenario | Max Profit / Loss | Probability of Profit/Loss | Executed results on 100 trades |

|---|---|---|---|

| Max Loss on Trade | -$266 | 40% | -$10,640 |

| Max Gain on Trade | $133 | 60% | $7,980 |

| BAD RESULT! -----> | -$2,660 |

So given that this appears to be a losing system – why bother to trade it?

Well, the above table has the following built in assumptions:

1 We hold everything to expiration and don’t do anything at all

2 The trade loss is ALWAYS the max loss – in practice that is not true.

Fortunately we can modify the assumptions

1 We do not need to hold to expiration

2 We can take winners early – if during the trade lifetime a profit target is reached then the trade can be exited.

3 We let the losers go and do not try to exit – but we can assume that not all of the losers will be max loss

So what does that look like ?

It turns out that with Iron Condors (and many other trades) that although a trade might ULTIMATELY end up being a loser AT EXPIRATION, and at some point in its trade lifetime you have the chance to exit with a winner.

Mechanics of Risk Reward video showed that the optimal time to exit is at 50% of max profit, and if you do that you have an 88% chance of exiting with a winner. Which is much better than the original 60% that the expiration probabilties would imply. To repeat the same thing differently, because its important – you have an 88% chance exiting with a 50% of max profit.

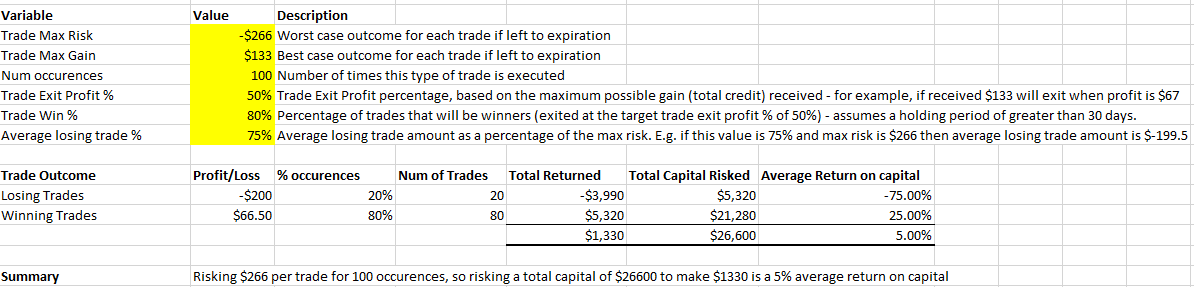

The above is based on being able to exit an anytime during the trade – but we have to work with the 30 day rule. So we would need to estimate the chances of exiting with a 50% after holding for 30 days inclusive. You can see the values we selected on the spreadsheet below (screenshot below) which allows us to model the concepts relatively easily:

Assumptions

The more times the strategy is run, the results should converge towards a much more predictable outcome – therefore theoritically the more you trade, the more likely you are to get the expected results.

Exiting winners with required trade exit profit % (e.g. 50% ) can be automated with Good Til Cancelled (GTC) orders (importantly after the 30 day holding period has passed).

Wait ? What ever happened to “Cut your losers and let your winners run”. Generally good advice for stock trading, but this is limited risk/reward system – and we know the risk on order entry (so one trade cannot take us out of the game).

Conclusion

This was to try and improve the results of our existing Iron Condor in our IRA accounts. So far in 2016 markets are cooperating with high implied volatility, which is great for Iron Condor strategies you can get more credit on trade entry. We are still working on verifying the above system but plan to refine it and actively use it with more capital in 2016.