This post describes a medium term trade betting that the pound will trade lower on uncertainty into the June 23rd UK referendum on whether to exit the European Union (EU) – dubbed Brexit by the media.

The trade is to short Great British Pounds (GBP) using 3 Micro GBP /M6B futures in Jun 2016 (symbol /M6BM6), and long Euro (EUR) using 2 Micro EUR /M6E futures in Jun 2016 (symbol /M6EM6).

Each side has a notional value of approximately $26k USD. The 3:2 ratio is simply chosen so that the notional amounts are identical, because of the different contract sizes for each currency. Trade entry was 14th March. This idea was from an FX Crosses trade idea from tastytrade.com, but one that we think we can use within our 30 day Rule restrictions. Typically this would be a scalping trade for few hundred dollars over a day or so, but we will attempt to position trade for a month or more.

For the record personally don’t think that United Kingdom (UK) would vote for an European Union (EU) exit, but with numerous exit polls and political statements along the way there will be a lot of uncertainty into the final results announcement on Jun 2016. However we don’t think we have a crystal ball so our personal opinion is not really relevant, therefore trade will be exited early and not wait for final result. This is trade is focused on the expectation of uncertainty into the result not the final result itself. This is a trade to “buy the Rumour, sell the news” trade or more accurately – because part of trade involves shorting pounds – it should be “sell the Rumour, buy back before the news”.

GBP EUR Correlation

The GBP EUR pair has a very tight correlation of about 0.71 in the last year. So what does that mean for our trade ? To recap correlation values typically vary between -1.0 (negative) and 1.0 (positive). A highly positive correlation means that the two products will typically move in the same direction mostly of the time (S&P 500 ETF (SPY) and Nasdaq (QQQ) would be a good example). A highly negative correlation means that the two products typically move in the opposite direction most of the time (S&P 500 ETF (SPY) and Volatility (VXX) would be a good example. Typically you would be looking for pair trades that were either below -0.5 or above 0.5 – because anything in between that range does not give enough of a correlation pattern (it could just be considered noise).

For the following we are using the relative charts of the ETFs FXB (Pound) & FXE (Euro) to show daily moves over a monthly time frame. For our high level correlation analysis, these E-micro futures move almost identically to these ETFs, so they can be considered equal for this analysis.

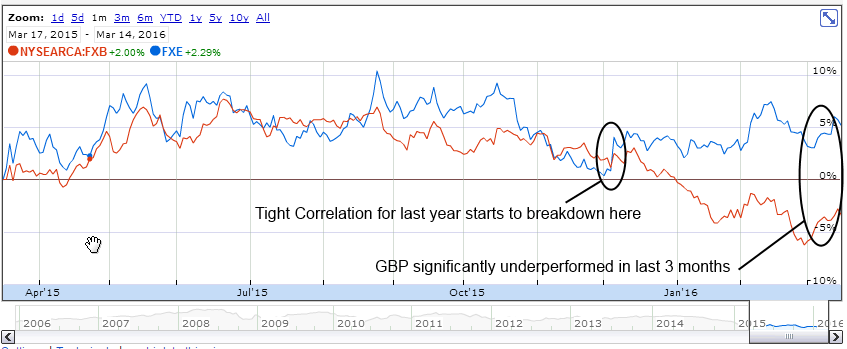

The GBP EUR pair has a very tight correlation for the 9 months of the last year, but there has been a recent 3 month divergence since Dec 2015:

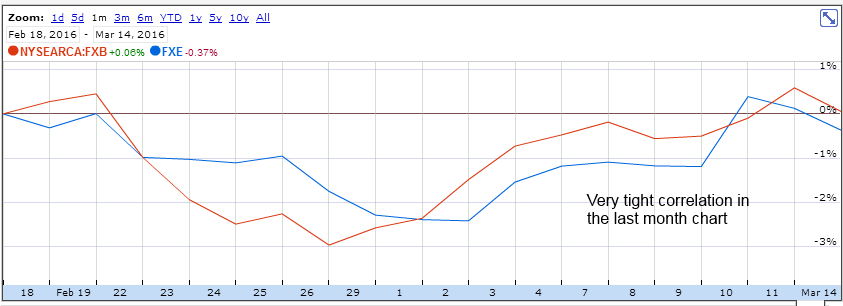

For reference in the last month has extremely tightly correlated:

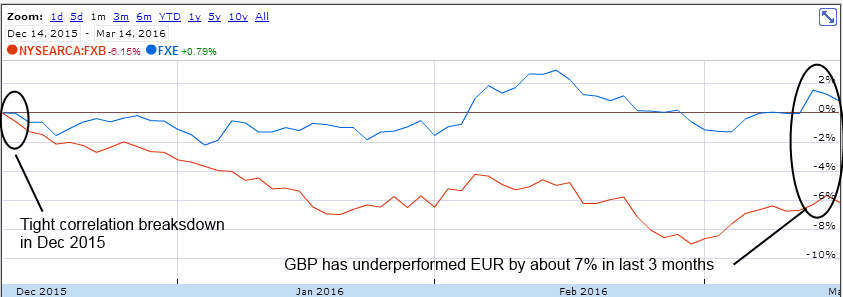

However looking at a zoomed in chart of the last 3 months it is easy to see that GBP has underperformed EUR by about 7%:

FED meeting – March 16th

Apart from general market risk, the FX market experiences higher implied volatility and rapid directional moves around central bank announcements. The FED announcement on March 16th and BOE announcement on March 17th will affect this trade.

This trade was not made delta neutral into FED meeting on March 16th. This is because the direction of euro and pound will likely be the same, even if the actual direction is unknown before hand. This trade does not make money guessing direction correctly, it makes money assuming the Pound under performs the Euro in the next month or so. Typically the euro and pound will trade in the same direction, but because we are long/short as a pair in the same amount the direction risk is minimized. It is possible, but not very likely, that the Euro and Pound trade in opposite directions after the FED announcement.

BOE meeting – March 17th

However this trade was made delta neutral before the BOE meeting on March 17th. This was because this is event directly specific to one of the currencies in the trade pair. Remember the aim of the trade is to express the view that the Pound will be weaker than the Euro over the lifetime of the trade into a potential Brexit – however trading central back announcements is just a trade outcome that cant be easily predicted and FX rates react in a very binary way (up or down very quickly). Since this event has the potential to move the GBP side of pair significantly, this introduces unnecessary event risk into our pair, so we will neutralise the trade for the event, and then re-evaluate afterwards.

The trade was totally hedged the night before the event, by purchasing about $26k GBP/USD spot FX and selling about $26k EUR/USD (the exact opposite of our futures position). We cannot exit any trade legs immediately due to the 30 day rule.

At luck would have it, after the BOE meeting at 8am EST on March 17th, GBP moved rapidly higher (i.e. against our original position). By 4pm Thursday compared to 24 hours earlier before the BOE announcement (but after the FED announcement) GBP was 1.53% higher and EUR was 0.76% higher. If we had remained unhedged in the original futures only position into the BOE announcement, this would have lost approximately 0.77% of our trade, or would have lost about $200 of our unrealized $350 profit. However since the trade was now totally delta neutral so our unrealized $350 profit remained, because the spot FX positions exactly offset any movement in the micro futures (as expected).

Brexit Trade Exit – March 17th

Since we have a locked in guaranteed $350 gain, we may just hold the entire structure for a month due 30 day rule then exit with a gain. In future we would also probably just use GBP/USD or EUR/USD spot FX (standard FX trades) versus the Micro GBP /M6B and Micro EUR /M6E futures. Given that the BOE meeting was bullish for GBP we can simply hold this trade with no modifications. However in 30 days time we can reestablish this trade (if we still want to trade the potential Brexit) simply by trading out of the spot FX positions. Alternatively we can just exit all the legs simultaneously and take the profit.